|

As a business owner, have you ever felt left out of a conversation when others start to talk about their financial statement reports? When you start to hear words such as, P&L, profit and loss, statement of earnings or income statement --- the conversation may start to feel a bit awkward and overwhelming. That’s why we’re going to dive into how to understand more these statements. Understanding the income statement is essential to business owners and investors as it provides an overview of the profitability and future growth of your business. All business owners should see the income statement as a simple and straight forward report on a business’s cash generating ability. It is a scoreboard on the financial performance of your business that reflects when sales are made and expenses are incurred. The official definition says an income statement is: A financial statement generated monthly and/or annually that reports the earnings of a company by stating all relevant revenues (or gross income) and expenses in order to calculate net income. Also referred to as a profit and lost statement. The income statement is one of the five financial statements issued by a business. It reports the amount a corporation has earned during the period between two balance sheet dates. Here are 3 things you should know about an income statement: Income Statements come with Accounting Jargon One thing that can make entrepreneurs shy away from financial statement conversations is the jargon used. The jargon can make it seem more complex than it really is. For example, the term “sales” or “income” might be used instead of revenue. “Expenses” and “costs” are also used interchangeably. “Profit” is sometimes called “net income. Income Statements cover a period of time The income statement reveals how much money your business made over a period of time. Most often, the statement will reflect the performance over a month, a quarter or a year. For example, you might hear the words, year to date, or see “Y-T-D December 31”, indicating the period for Jan 1 to Dec 31. Income Statement follows a formula Every income statement, no matter how complex, follows a very simple formula. Revenue – Expenses = Profit For the period specified on the income statement, it will show the revenue the business earned, the expenses it incurred and the profit it made. If you want to understand how your business operations flows, the income statement can help give you a better picture of what makes your company profitable and where the losses are coming from.

12 Comments

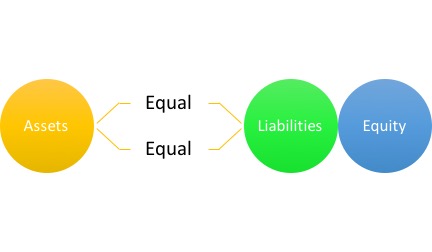

Well, maybe this blog will not make you snuggle up with an Accounting book at night and call it your BFF but I will go for making you two close friends. Close friends because you need this person in your life for your business to be successful. There are millions of small business owners and startup entrepreneurs who are masters at creating products and services and winning over customers. However, many of them are weak in understanding the accounting area of the business. To be effective in grasping the concept of accounting, I find it useful to understand some of the commonly used terminology. Essentially, accounting is about managing debits and credits. Those debits and credit are recorded and managed by the business owner, consultant or bookkeeper of the business, mainly to ensure money is coming into the bank and expenses are being paid timely. The American Accounting Association (AAA) defines accounting as “the process of identifying, measuring and communicating economic information to permit informed judgement and decision by users of the information.” The basic formula to accounting is: Assets = Liabilities + Equity (Owner’s equity)  Knowing the basics equation, outlined above, will assist in the understanding of accounting account types. There are different types of accounts in which debits and credits are kept track of in accounting, let’s define some them,

When managing your business, these definitions will be used quite frequently especially if you have hired a consultant or bookkeeping to manage the accounting area of your business. Let’s say your current business is a hair professional in a Salon and at the end of the day your analyzing how much you made for the day. Your recording book shows:

The owner of the salon may generally record total earned revenues of $175. However, to an accountant or bookkeeper they are also concerned with how much it cost (expenses) the Salon owner to make the two conditioners she sold for $10 each and how much was it to purchase the comb and hair sprays. Understanding this information gives the true net revenue amount of how much the salon owner made for her one day of work. The take away here, is to remember it takes more than developing marketing techniques and creating new products and services to manage a business. As a business owner, your accounting processes and methods used to analyze should be your BFF in the business because without it, you can never know where it stands or how healthy or unhealthy it is. If you understand the importance of accounting to your business and are ready to protect your business from financial risk, visit our website to schedule your consultation. When an idea is developed into a business, establishing the accounting processes to track the revenue and expenses is generally not on the top of the list. A chart of accounts short name is (COA) and is defined as “a listing of the names of accounts that a company has identified and made available for recording transactions in its general ledger.” A chart of accounts has standard accounts you may see despite the industry of business you work in. However, typically the order of the accounts are as follows: Balance sheet accounts:

Income statement accounts:

Your account receivables are considered an asset, and so is your income but they are two completely different things. Account receivables are created by the sale of goods or services but income is what you have received from the sale of goods or services. You see, if you bill a customer and give them time to pay it is accounts receivable, and when you receive the money via deposit into your bank account then that is income. Many business owners may be using an accounting software to manage their chart of accounts. The software may provide a list of custom accounts to use but it will be the responsibility of the respective business owner to add custom accounts to ensure finances are recorded accurately. Below is an example of the chart of accounts for a Salon professional: Assets:

Fixed Assets:

Expenses:

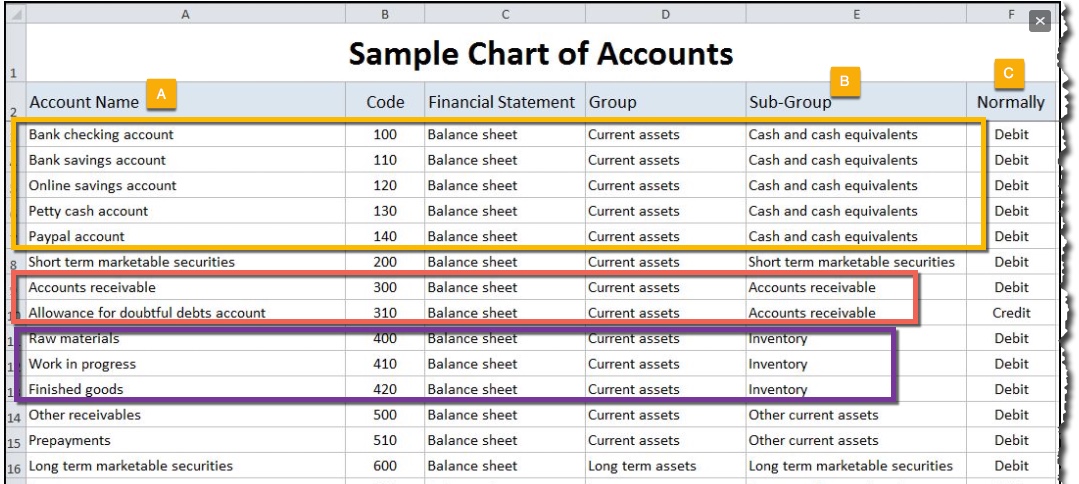

A chart of accounts generally serves as an outline for the business structure and is a tool for gathering and organizing financial information. The chart of accounts example below is one sample guide. It identifies the account name (A), this name will depend on your type of business and sub-group (B), is dividing the chart of accounts into groups for financial representation and normally (C), indicates whether the account is normally increased by a debit entry or credit. For example, depending on the size of business the leader may have one individual responsible for reconciling all of the cash accounts to ensure online, in-store or one-time made purchases are all accounted for on a daily basis. But, in another business the leader may assign cash and accounts receivable to one individual (not recommended, but could happen) and they would be responsible for ensuring all cashed is received and accounted plus for in addition,

The debit and credit column indicates whether the account is normally increased by a debit or a credit. As an example, expense accounts are normally increased by a debit entry but income accounts are increased by a credit. If your looking to strengthen the accounting processes of your business, Fontenot & Associates Solutions LLC has the skills and tools to get you started. Even though your business may be a one person shop, the organization of your finances should be accurate and organized from day one. Getting started is simple, let us show you how. How is that Going for You? How does one define a non-profit organization? It has been defined as entities that perform charitable services by accepting funds from the general public. To help regulate the activities and encourage proper allocation of funds, accounting standards have been put in place by the Financial Accounting Standards Board also known as FASB. The accounting standards are used by management of non-profit organizations as a guide to record transactions and comply with program requirements. Many non-profit organizations exist to accomplish a goal and not to return a profit however as funding opportunities present themselves and partnerships begin to form, the financial statements will need to be accurately managed by a designated accountant or management. The finances are generally budgeted and every line item within the financials are accounted for. The operational budget is the foundation from which all of the work will be carried out. It allows you to establish benchmarks and determine priorities. In addition, it brings light to the variable cost which may exist and allows management to analyze and change the to fixed cost. Here are some key steps in developing your budget:

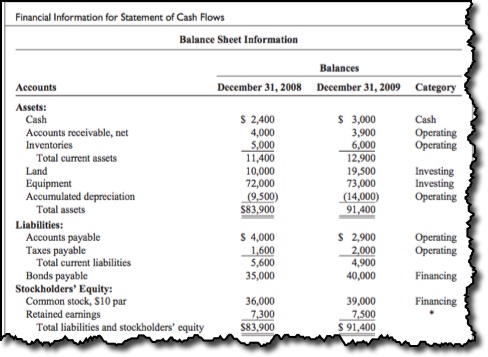

These steps are sufficient and valid for a newly established non-profit organization and those who have been established for five or more years. A well established and maintained budget is what donors look for. Donors want to know where the money is going. They want to give their money away to "a worthy cause", and it is management's responsibility to show them that that's what is occurring. Showing that you're non-profit organization is worthy starts with a good budgeting process which engages those who are responsible for adhering to the budget and implementing the organization's objectives in creating the budget. Get started today with the annual budgeting process, is it documented, with task, responsibility assignments and deadlines clearly state? It is never too late to get started. Fontenot & Associates Solutions, LLC offers the skills and experience to prepare the annual budgeting procedures in advance which will ensure proper delegation of assignments and the delivery of a clear message. The meaning of life is to find your gift. The purpose of life is to give it away." - Pablo Picasso “Empower yourself and realize the importance of contributing to the world by living your talent. Work on what you love. You are responsible for the talent that has been entrusted to you.” Cash inflows and outflows are determined by analyzing all balance sheet accounts other than the cash and cash equivalent accounts. The following account balance changes indicate cash inflows:

Cash outflows are indicated by the following account balance changes:

As an Accountant it is important to remember that three techniques may be used to prepare the statement of cash flows:

Continue to grow in your professional role and don't be afraid to share that knowledge with your team! It's Time To Listen to What Your Budget Can Tell YouAs a business owner you may be challenged with identifying the best plan for your business structure. When it comes to budgeting, let's be clear that it is different when compared to a long-range planning. One important difference is the time period involved. The maximum length of a budget is usually a year, and budgets are often prepared for shorter periods of time, such as a month or a quarter. In contrast, long-range planning usually encompasses a period of at least five years. A second significant difference is in emphasis. Budgeting focuses on achieving specific short-term goals, such as meeting annual profit objectives. Long-range planning, on the other hand, identifies long-term goals, selects strategies to achieve those goals, and develops policies and plans to implement the strategies. To choose a strategy that will work best for your business starts with being realistic as possible. A budget can be used to indicate some of the following:

The final difference between budgeting and long-range planning relates to the amount of detail presented. Budgets, can be very detailed. Long-range plans contain considerably less detail. The primary objective of long-range planning is to develop the best strategy to maximize the company's performance over an extended future period. Your success is what matters to Fontenot & Associates Solutions LLC. It's never too late to get started -- visit our website today to learn more. Without continual growth and progress, such words as improvement, achievement, and success have no meaning. – Benjamin Franklin “Ideas are easy. Implementation is hard.” – Guy Kawasaki, co-founder Alltop Let's assume that you have been getting away with creating or maintaining a budget thus far and see no need to make the additional time and create one. But, what about the two o'clock meeting next week you have with a potential partner or investor? How will you show them the potential growth of your company? A budget is a great way to display your businesses objectives and goals to a third party. So, why wouldn't you take the time to create an exercise this important?

Research shows the primary benefits of budgeting have been identified as follows:

Fontenot & Associates Solutions LLC can develop an extensive guide for your key Accountant, to ensure the development and detail support for the budget is accurate. A budget is only as accurate as the data used. Visit our website today to schedule your consultation - today! Why should accounting be your profession of choice? When I made the decision it's one that never changed. It started with taxes then lead to financial and banking support which now leads me to an even broader window of teaching and fulfillment. Now, why should you join me and many others on this journey? Perhaps the American Institute of Certified Public Accountants (AICPA) summarized it best in its newly issued pamphlet: "Accounting: The One Degree with 360 Degrees of Possibilities": "You may already have an idea about what you want to do for a career. Then again, maybe you're not so sure. Either way, there's one degree that gives you the education to succeed at just about anything in the business world. It's an accounting degree. Accounting opens doors in every kind of business coast to coast. It can give you the foundation you need to go on and become a CPA. It can prepare you to become a partner in an accounting firm, to pursue a career in finance or corporate management, to work in government, or even to become an entrepreneur. In fact, no matter what you decide to do, having an accounting background can open doors wide." Accounting is a profession for those interested in math, business and who also have the skills to think outside of the box. An accounting degree can open up many opportunities in varies industries with rewarding compensation. USA Today has done most of the work for our young professionals by listing the "Top 10 colleges for an accounting degree". Check it out to see if your college selection made that list. If you're an entrepreneur seeking to strengthen this area of your business, visit our webpage for a free consultation. We look forward to hearing from you. The Accounting profession rules! . “High expectations are the key to everything.” – Sam Walton, founder Walmart Analysis is a KeY Tool to Pointing Out A Financial IssueBeyond the belief of many business owners who hire employees with 20+ years of experience, not all professionals are skilled to analyze data without management direction. The skill of analytics has been identified as beyond necessary as well as critical to the compliance and financial position of an organization. The analysis of financial data employs various techniques to emphasize the comparative and relative importance of the data presented and to evaluate the position of the firm. These techniques include ratio analysis, common-size analysis, review of descriptive material and comparison of results with other types of data. The information derived from these types of analysis should be blended to determine the overall financial position. The American Management Association research has shown that analytics are important today and will be even more important in the future."Overall, 58% of company leaders say analytics are important to their organizations now, and 82% say they will be important in five years. Less than 1% of companies say analytics will not be important to their business in five years, an unambiguous indication that analytics will be a ubiquitous part of the business world by the end of the decade." Business owners must remember that financial statement analysis is a judgmental process. One of the primary objectives is identification of major changes (turning points) in trends, amounts, and relationships and investigation of the reasons underlying those changes. Often, a turning point may signal an early warning of a significant shift in the future success or failure of the business. Knowing this, ignites the importance of establishing extensive policies and procedures for staff professional development and process improvements. It's a fact that absolute figures or ratios appear meaningless unless compared to other figures or ratios. Having 60% of total assets composed of buildings and equipment would be normal for some companies but disastrous for others. One must have a guide to determine the meaning of the ratios and other measures. One type is trend analysis which studies the financial history of a business for comparison. By looking at the trend of a particular ratio, one sees whether that ratio is falling, rising or remaining relatively constant. The factors help detect problems or observe good management. A great example of the month to month financial comparison analysis is provided below by Illinois Small Business Development Center. A businesses ratios are more than just numbers to your investors and banks and should mean the same to a companies professional staff. Take the first step in improving the business culture plus the professional skills and knowledge base of staff which can lead to the prevention of costing companies millions due to preventive errors or non-compliance matters by developing an extensive reference guide tool. Click here to let us know when you would like to get started! Embrace what you don’t know, especially in the beginning, because what you don’t know can become your greatest asset. It ensures that you will absolutely be doing things different from everybody else.” Entrepreneurs, let's consider this scenario. Your business has expanded quicker than you expected and payroll needs to be processed in the next two business days. As the owner and key responsible for the processing of payroll, you have been faced with a proposal deadline that you cannot miss. What do you do without a trained back-up person? Ideally, you will immediately contact Fontenot & Associates Solutions LLC to schedule your FREE consultation to develop an extensive procedure guide to ensure situation never occurs again. Realistically, as the owner you going to work day and night to get both jobs done on time. The business process should include a section related to "deductions from employee earnings" which outlines which deductions are allowed and the proper way to set those up for processing. The total earning of an employee for a payroll period, including any overtime pay, are called gross pay. From this amount is subtracted one or more deductions to arrive at the net pay. The deductions normally include federal, state, local income taxes, medical insurance, and pension contributions. A key and critical deduction employers are responsible for is income taxes. Employers normally withheld a portion of employee earnings for payment of the employees' federal income tax. Each employee authorizes the amount to be withheld by completing an "Employee's Withholding Allowance Certificate,"called a W-4. This is the form every employee receives when they start a new job with an employer. A blank form that many people may not understand completely what it means and the importance of it - especially our young college graduates and young entrepreneurs. A question that remains for many employees, is what do the allowances mean and how do allowances work? A simple answer is: The number of allowances you claim controls how much will be withheld from your paycheck. The more you claim, the less money is withheld; the fewer, the more of your salary is sent off to the IRS. If you are a single (not married) individual with no dependents (no children) your completed W-4 form may be similar to the example below. The completion of this worksheet shows Carlie will claim "2" exemptions, mainly because the first questions says you can claim "1" if no one else can claim you as a dependent. This is key for college students who have their own job but the parents are still claiming them as an exemption on their tax return because they qualify. Quick note, if your parents can still claim you on their tax return, the first question "A" should be zero. As an employer, you may also be required to withhold state or city income taxes. The amounts to be withheld are determined on state-by-state and city-by-city bases. Fontenot & Associates Solutions LLC, has the knowledge and skills to develop an extensive guide for employers and their staff to ensure forms such as this are in compliance. Click here to contact us! Source: CorporateFinancialAccounting;IRS.gov Don’t limit yourself. Many people limit themselves to what they think they can do. You can go as far as your mind lets you. What you believe, remember, you can achieve.” |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed