|

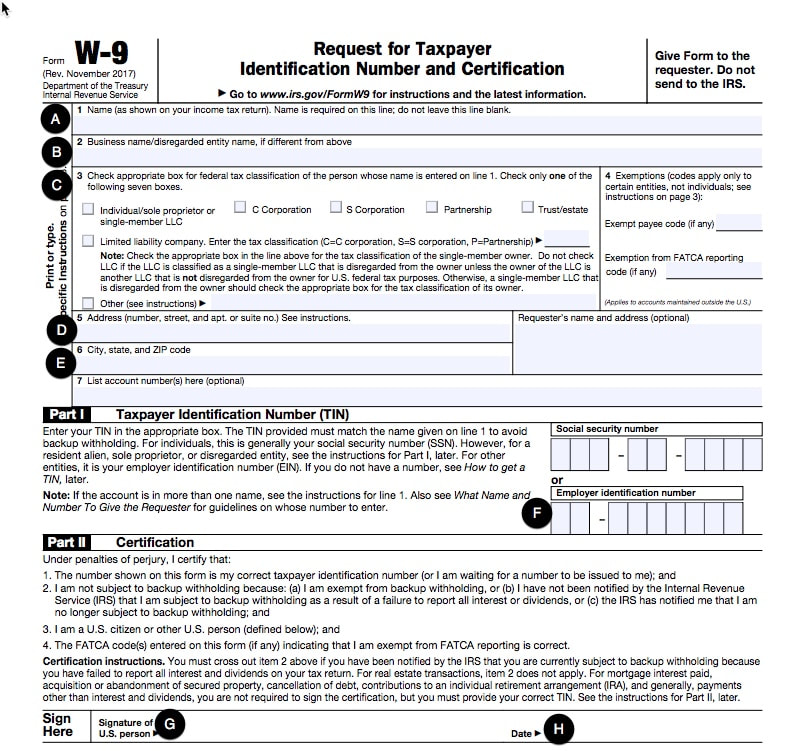

The IRS Form W-9 is important for small business owners. You will need this whenever you hire an independent contractor for your business. It’s a good idea to have all independent contractors complete this form before you pay them.

As a company you will use the information provided by the independent contractor to prepare the Form 1099-MISC, reporting to the Internal Revenue Service the amount of income that was paid to the independent contractor by your company. The W-9 form also contains boxes to check showing how the contractor’s business is legally organized. This includes sole proprietor, C Corporation, S Corporation, Partnership, or Limited Liability Company. When contractors sign the W-9, they certify under penalty of perjury that they have completed the form correctly. They also certify they are not subject to backup withholding and are a U.S. citizen. The IRS states that anyone that receives payment of $600 or more over the course of a tax year needs to fill out the Form W-9. The best rule in practice is to collect the form anytime you pay someone for anything, even if it’s below the $600 threshold. The Form W-9 does not have to be filed with the IRS. It will be important to maintain the signed form in your files. Completing Form W-9 is pretty straightforward. The contractor should just indicate the business name and their employer identification number (EIN), also known as the tax ID number. When the form is completed, the contractor is certifying to the IRS that the tax ID number being provided is correct and accurate. When running your own business you may have to hire independent contractors and this process requires you to track and maintain files in order to run an effective and compliant business. Make no mistake, your business staff and management team should have a clear understanding of what the W-9 form is and when to use it.

6 Comments

3 Top Benefits to Outsourcing For Small BusinessesWhile you might think that only large and multinational corporations - can benefit from outsourcing, small businesses can potentially realize even bigger outsourcing benefits because of how many new jobs are actually being created within smaller companies. According to the Small Business Administration, companies with less than 500 employees account for almost 65 percent of new private sector employment.

Outsourcing refers to the way in which companies entrust the processes of their business functions to external vendors or small businesses. There are many benefits of outsourcing your business processes.

Building a business includes more than just picking a location, developing a business plan, building a website or picking your social media platform. Some of you may be asking what could be more important. Well, I'm here to tell you that opening a business bank account should be on your top 5 of "things to do" list. Having a business checking account can help you deal with tax, legal and practical issues. Many business owners choose to manage their business and personal finances within the same bank account for the purpose of convenience and but fail to realize the advantages that come with managing a separate business account. A major reason that companies use bank accounts is for internal control. Here are a couple of the control advantages of using bank accounts:

Keep in mind, the Internal Revenue Service (IRS) is really picky about business owners being able to show that their business is really a business and not a hobby. Basically, you have to show a profit on Federal Tax Form Schedule C three years out of every five. Having a separate business bank account established further proves you are a business and not a hobby business. As your business grows, it becomes critical to build a proper legal and financial foundation. Opening a separate bank account is one small step in that direction, and will help keep your accounting records organized.

Cash doesn’t always flow how you need it to. It can start from customers who pay late to suppliers who have suffered some kind of setback. Building a cushion in your bank account isn't a complicated concept, instead of having just enough to pay bills and staff it is time to have a larger amount in the account. An amount that will not only allow for timely payments of monthly billings but enough to transfer into savings. Maintaining a smooth cash flow requires juggling many aspects of the business such as staying on top of “pending cash”, also known as accounts receivable, to -

Cash flow is the life of an organization, it’s a means to pay salaries, buy supplies and make stock investments. As the statistics have shown, owners who cannot efficiently manage their business cash flow are almost certain to fail. To improve cash flow and sustain growth it will be important to build a cash cushion. Having cash reserves enables companies to cope with a business disruption, deal with seasonality, and manage slow-paying customers. It allows a business to take advantage of new opportunities should they arise, and plan for future growth by having investment capital available. Here are just a few tips on how to business owners can boost their cash flow:

The efforts to implement meaningful changes within the business will be a combination of lessons learned. Building and keeping an adequate accumulation of cash provides maximum opportunity and flexibility to any business. Fontenot & Associates Solutions, LLC recommends identifying the method or strategies which work for your business culture. Building a stable long-term business means having sufficient liquidity and a developed and executed form of policy and procedures with clarity defined goals. Can you recall the last time you encountered a brain freeze? The thought of Accounting may cause brain freezes for new entrepreneurs but the basics I’m about to share with you will ease the pressure of what Accounting means to your business when getting started.

Here are five ways to understanding Accounting in your business: 1. The business structure must fit It is up to you to choose which kind of structure is best for you and your business, but the importance to the process is not to guess with your selection. This decision matters to the tax structure your business will be obligated to understand and to the amount of paperwork to complete. The most common forms of business are sole proprietorship, partnership, limited liability company (LLC) corporation and S corporation. Each form comes with different tax consequences, you will have to make your selection wisely and choose the structure that best matches your business needs. Below are some of the tax implications to the most common business tax structures:

2. Business activity needs a bank account The ability to maximize your business revenue starts with understanding what is required to be reported. The separation of business income and expenses from personal is by far one of the most important actions to take first. This can be accomplished with the setup of a new bank account exclusively for your business. Many banks offer an introductory period of free banking which could be a few months or longer but it is key to understand what that means for your business after the introductory period. Don’t feel obligated to open a bank account with your current bank, get the best deal and setup for you and your business. In order to open a business account, you’re required to have a business name, which may be a DBA or one of the common business structures formed and registered with your State. Do your research on bank requirement. 3. Budget with the funds you have As a new entrepreneur you may see a budget as a future goal or task for your business but that is far from the truth. You are certainly spending money when starting a new business thus why not understand how much you can truly afford to spend. The first three months of the business can be the most critical time frame to identify how much income is necessary to manage and maintain as well as how much you can afford to spend on business expenses. Allow your budget to be your weekly or monthly resource to understanding your business cash flow. 4. Track your expenses as they occur It’ s one thing to say you are in business and another to develop a habit of consistency to track your expenses. More often than not you may find yourself meeting and building relationships with new clients, traveling to a speaking engagement or replacing supplies with the use of your personal debit banking card or credit card. If you miss capturing these cost, not only will your business pay more tax than necessary but you also do not have a good record of how much your business is costing you. 5. Get paid for your services You are contracted to complete the work, now its time to get paid. Have a payment policy in place which screams “professional” to clients and helps ensure that you and your clients are on the same page right front he outset, says John Rampton, VP from Entrepreneur Magazine. You may also consider offering customers a discount for paying invoices early, can help you get paid more quickly too. For instance, if you usually policy is to have payments due in 30 days, offer a small discount such as two percent to customers who pay within 14 days. You don't have to build your business alone. Allow us to eliminate the brain freezes you or your management team encounter when it come to planning for financial stability and growth. Let's discuss a more efficient way to set your business financially apart! We are scheduling consultations now, email [email protected]. I don't know about you but this tax season seems to be moving at an accelerated pace. However, we don't want you to move too fast that you miscalculate your taxable income, incidentally under report your business income or miss an important tax deadline. Fontenot & Associates Solutions, LLC has identified five (5) avoidable, but yet common small business tax pitfalls to share with you as we look for ways to help minimize your business expenses. We prefer that you keep any extra dollars earned in your bank account. 1. Making Deduction Mistakes - One of the most common mistakes made by small business owners is, not keeping accurate records of their expenses. While some may see it as a tedious task, Fontenot & Associates Solutions, LLC would like you to see it as taking the initiative to avoid spending countless dollars on penalties to the IRS. 2. Charity Donation Pitfalls - Charity donations should not be your go to deduction when trying to reduce your taxable income. If you donate to charity, you will need to keep an accurate list of the items donated and its value. In addition, obtain a receipt from the location, which should be a reputable one. This will help to avoid a 25 percent penalty. 3. Inaccurate Tax Returns - If you made an error on your tax return that results in you owing more tax, the IRS can charge you a late payment penalty on the amount still owed. This could be a costly mistake for m any small business owners, especially since the penalty is 0.5 percent per month or partial month, to a maximum of 25 percent of the amount owed. A recommended solution to this tax pitfall is to review your business transactions at least quarterly for accuracy.

4. Failing to Making a Payment on Time - While some of these pitfalls may not be intentional, it does not stop the IRS from penalizing you and assessing a 0.5 to 1 percent penalty each month on an unpaid tax bill. 5. Civil Fraud Pitfalls - A huge pitfall a small business owner can make is to underreport income with fraudulent intent. Not reporting all of the income earned on your federal tax return, on purpose, can cost you not only huge penalties but also a charge for criminal tax fraud. The penalties fined can be as much as 75 percent of the amount you failed to report. This pitfall is not one to take lightly and is completely avoidable with the proper business processes in place. The solution to all of these pitfalls, starts with keeping accurate records. Small business owners may also consider hiring a professional to support them and/or their team. Remember, you are in business to build and grow. An audit has caused many small businesses to close their doors because of underreported income or high penalties for fraud - this does not have to be your business. We are here to support! Planning is a key tool to any business when just getting started and when planning to grow. It becomes essential to review your business plan to ensure business activities are meeting business needs.

A business plan is a guide – a roadmap for your business that outlines goals and details of how you plan to achieve those goals. Developing a business plan may seem scary and overwhelming but keep in mind that it does not have to be a long and formal document, like a college thesis. This process is much less daunting than it used to be. When getting started be prepared to keep it concise and short. By keeping it short than you are more than likely to reference back to the document when it comes time to make changes and refine it over time. If you know your business and are passionate about it, writing a business plan and then leveraging your plan for growth will be easy breezy. Think about it like this, if you have ever jotted down a business idea on a napkin, in a journal or as a research paper with a few task to be accomplished, then you have written a business plan, or at least a very basic one. As a new business, a business plan can help you clarify meaningful pieces, like expense budges and tasks. Existing businesses will use a plan to help manage and steer the business. Business owners may use a plan to reinforce strategy, manage responsibilities and goals or plan resources including cash flow. Now it is time for you to jump start your plan: 1. Executive Summary This is an over of your business and your plans. 2.Company Overview This provides a quick review of the company’s legal structure and location, as well as some background on the company’s history. 3.Products and services This will bring clarity to what you will be selling and how are you solving a problem. 4.Target market This will outline who you are selling to. 5.Marketing and sales plan This will describe how you are going to reach your target market. 6.Financial Plan This will provide a financial forecast to your business. Will include monthly projections for the first 12 months and then annual projections for the remaining three to five years. If you do not plan in your business, you are planning to fail! Our firm can support your business with the initial development or revision of your business plan. Let us know when you are ready to get started! You can schedule your no obligation consultation with us today. Maybe the time has come and your decision be a multi-tasker, creative developer and profit creator is no longer your plan for future growth. Have you considered outsourcing? Outsourcing can be defined as “the strategic use of outside resources to perform activities traditionally handled by internal staff and resources.” As you develop your business strategic plan for remainder of this quarter, ask yourself, what processes are you contemplating to be more beneficial to your time and efforts as an outsourced process? Did you know? More small businesses are outsourcing task these days technology has advanced to the point of professionals being able to work virtually from anywhere in the world by extremely qualified professionals who have decided or been forced to leave corporate America, such as virtual assistants, graphic designers, paralegals, bookkeepers, operational policy developers and the list goes on. The right time to outsource can be different for each business but the key reasons of why cannot be ignored. Here are 4 reasons you should consider outsourcing to help maximize your business:

1. Customer satisfaction It will show to be an amazing benefit to your business when efficiency has increased and the positive impact on the satisfaction of your customers. You will be able to learn more about what your clients need and produce your products and services faster. You don’t need to be in the weeds of the administrative task such as accounting, these tasks can be outsourced which then allows you the ability to focus more on central functions of the business. 2. Labor Costs One of the main reasons businesses began outsourcing is because it is an effective way to decrease labor costs. This is because, rather than employing several full-time staff who are on the payroll even when their services may not be required, outsourcing provides you with a flexible workforce. You will also save money on expenses such as training, sick leave and vacation. 3. Resources Making the decision to outsource some of your business functions can give your business access to new resources and frees up resources that would otherwise be devoted to those back-end functions. When you decide to outsource, you can focus on what you’re good at and let experienced professional take care of support functions. 4. Efficiency Outsourcing also leads to increased efficiency, because you are entrusting business functions to third-party experts. Since these parties are specialists in their area, they are intimately familiar with ins and outs in a way that members of your staff couldn’t be without extensive investment and training. If any of these reasons ignite the fire for you to finally see the advantageous to outsourcing for your business, don’t hesitate another day. It’s now time to develop a plan of action. Decide which areas of your business would be best outsourced to a third party and execute. Our firm, Fontenot & Associates Solutions, LLC, specializes in developing key operational policies and procedures that will not only protect your business but also streamline and financially maximize your bottom line. You can learn more about our list of services by visiting us on the web. As you wrap up another year of business accomplishes and defeats, it becomes an ideal time to conduct a yearly review of business activity for future planning. Building a cushion in your bank account isn't a complicated concept, instead of having just enough to pay bills and staff it is time to have a larger amount in the account. An amount that will not only allow for timely payments of monthly billings but enough to transfer into savings. Cash flow is the life of an organization, its a means to pay salaries, buy supplies and make stock investments. As the statistics have shown, owners who cannot efficiently manage their business cash flow are almost certain to fail. To improve cash flow and sustain growth it will be important to build a cash cushion. Having cash reserves enables companies to cope with a business disruption, deal with seasonality, and manage slow-paying customers. It allows a business to take advantage of new opportunities should they arise, and plan for future growth by having investment capital available. Here are just a few tips on how to business owners can boost their cash flow:

Fontenot & Associates Solutions, LLC recommends identifying the method or strategies which work for your business culture. Building a stable business for long term means having sufficient liquidity and a developed and executed form of policy and procedures with clear defined goals. Does you current budget for marketing meet expectations? - Fontenot & Associates Solutions, LLC I don't know about you but I'm tired of the small business statistics, according to Small Business Administration research, that report, only half of new businesses survive for the first five years and only one-third of new businesses are able to survive for 10 years. Knowing what steps one would take to solve problems when they occur, because they will occur, can go a long way toward saving your company. While any unforeseen situation can cause for a nightmare, one important factor to question all business owners should ask themselves is, do I have a solid financial footing in place? Regardless of how the business fares out, it should not make your personal financial matters worse. Negative cash flow can push successful businesses into tailspins, with profit driven efforts rapidly changing to panic and insecurity. If done properly, business owners should be able to detect problems brewing months away and develop uniquely designed strategic solutions. Unfortunately, many business owners don't have solund processes inplace to predict, revenue, expenses, and cash flows. Let's make note of 4 key ways to examine and maintain a positive cash flow:

As with any business, planning is essential. It's no secret that small business owners have a lot to do. The financial implications of business ownership are extensive, yet critical to a company's success. However, starting your own business could be the ticket to the personal autonomy and financial independence you’ve always wanted. Your vision will dictate your outcome. Fontenot & Associates Solutions, LLC is experienced with developing the business tools necessary to measure business success, visit us here to get started today. Did I mention you can also find our article about your business cash flow is on the online magazine, Business Business Business? |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed