|

My guess it that you are still considering the advantages of outsourcing certain aspects of your business today. This is great news! Fontenot & Associates Solutions, LLC would like to support you with making the best decision for your business today and for the future. Your business is unique and it is important to keep this knowledge at the forefront of your brain as you move forward. I say this to you because many business owners may choose to compare their business needs and goals with those of a colleagues and it is just not the same nor necessary. What two business are truly the same? Companies that decide to outsource do so for a number of reasons, all of which are based on realizing gains in business profitability and efficiency. What are areas in your business that can be more efficient? Does your work schedule demand flexibility? Are there minimal task that could be performed by a skilled professional which would then allow you to focus more on the companies marketing strategies? If you answered, yes, to any of these questions, it is time to streamline processes and task within your business. Research has shown, outsourcing, refers to the way in which companies entrust the processes of their business functions to external vendors or small businesses. Fontenot & Associates Solutions, LLC has listed a few of those advantages below:

Fontenot & Associates Solutions, LLC can support small businesses and corporations with internal accounting needs and with the development of unique policy and procedure that will support with measuring success and failures. Our goal is to set you and your business up from day one. If you can vision the future growth and dynamics of your business, we can help you measure it! “So often people are working hard at the wrong thing. Working on the right thing is probably more important than working hard.”

0 Comments

All achievements, all earned riches, have their beginning in an idea. – Napoleon Hill The accounts payable process (also known as A/P) or function is immensely important since it involves nearly all of a company's payments outside of payroll. Regardless of the company's size, the mission of accounts payable is to pay only the company's bills and invoices that are legitimate and accurate. The amount of invoices paid daily within a company will depend on the size and activity.

Key items an Accountant should look for when reviewing invoices are:

Research has identified a few tips related to accounts payable that may allow your business to run a bit smoother.

Find more solutions today, Fontenot & Associates Solutions, LLC. What kind of feeling do you get when you hear the words "Payroll"? If you feel joy and excitement, you more than likely the energetic professional who has worked their tail off and payday is the reminder of why you do it. But, if you have a sick feeling to your stomach then your more than likely the manager or business owner responsible to processing and analyzing the payroll for your team. A great deal of time is dedicated to the payroll process and management may feel anxiety because they do not have a team or outsourcing company to support with this sensitive information. This information should have its own set of extensively documented procedures inclusive of rules and regulations, along with a dedicated employee to manage the weekly or bi-weekly processing. A dedicated employee would allow for management to stay abreast of the state and federal government changes. A simple payroll for any business would be processing the same monthly salary for one employee; while a more complex payroll may have many staff, paid different amounts each week, with frequent joiners and leavers. With that being said, here are just a few tips:

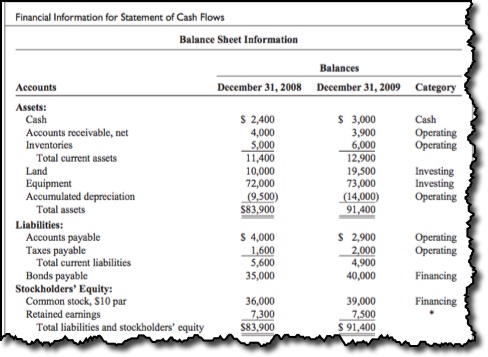

All achievements, all earned riches, have their beginning in an idea. – Napoleon Hill As a business founder you have to do everything possible to limit liability for any problems that occur. Understandingly so, things such as building relationships, professional networking and training are priority for a business owner in the start-up phase of their business. This is encouraged! However, as a small business owner when you start to work with more clients and hire more people into your company how will you manage the risk. Many business owners don't recognize how important the development of policies and procedures can be for a business. Having extensive policies and procedures in place before desperate situations appear can help with measuring both success and failure for a business owner. Research has shown that your business should have at least the following in writing before hiring any additional clients or employees aboard. 1. Use of Device Policies: This can be a critical factor for small business owners and is often overlooked when it comes to the importance . When employees are brought aboard they are matters in which the business owner is responsible for their actions. To ensure illegal matters are not conducted on company equipment businesses are encouraged to have a clearly written policy in place for employees. 2. Work hours and Turnaround Time: As a new business owner it is a great idea to ensure clients are aware of your working hours. Studies have shown that customers prefer to talk with a live representative within the company. Let this be a clear message to clients, in the developed policies and procedures, so that the expectations are established from the beginning. This will also answer the question for after hours and emergency support. The idea here is to set expectations upfront in order to avoid disappointment and dissatisfaction with clients. Whether your business handles coaching services or mobile computer repair services, you should have a clearly defined policy regarding response time. Clients look forward to your product or service after purchase therefore, you should have a written policy in place that will outline expectations. 3. Return/Refund Policies: Many business owners offer a quality guarantee or product can be returned with no fee to their clients. However, do you have it clearly outlined on your website or in written electronic form? Refunds are also a possibility for service oriented companies even though their is no product for sale. A client should know what to expect from the purchase of all products or services upfront - this will alleviate disappointment with new or existing clients. The development of written policies and procedures is a great way to protect your business and establish a fair working environment for employees. Policies and procedures should be extensive as possible in order to provide additional assurance of protecting the overall business. It is never to late to get started. You can schedule your consultation via the website of Fontenot & Associates Solutions LLC. Our goal is to protect you and your business from day one. Chat with you soon! "What you get by achieving your goals is not as important as what you become by achieving your goals." -Zig Ziglar “Empower yourself and realize the importance of contributing to the world by living your talent. Work on what you love. You are responsible for the talent that has been entrusted to you.” Cash inflows and outflows are determined by analyzing all balance sheet accounts other than the cash and cash equivalent accounts. The following account balance changes indicate cash inflows:

Cash outflows are indicated by the following account balance changes:

As an Accountant it is important to remember that three techniques may be used to prepare the statement of cash flows:

Continue to grow in your professional role and don't be afraid to share that knowledge with your team! Don't Be Confused About the Importance of Reconciling AccountsWhen I speak to small business owners about account reconciliations I often get the look of, my business does not need that. But, as a small business owner do at least have an idea of when you may need it? Is it documented in your business plan of when you will execute the process and train your assistant or staff on how to complete the task? These are the questions I would like many small business owner who are busy with building their business to consider and think about for a moment. I would like to share a great example of a standardized process I read recently in an article published by Journal of Accountancy, which was golf courses. Can you imagine the chaos that would exist if holes weren't numbered and golfers could choose to play any hole they wanted at any time? The same holds true with a company's account reconciliation process. In our August 2016 "Fontenot News", we share our knowledge, research and identify the importance of account reconciling for your business. Enjoy it! I encourage you to share it with one of your colleagues today and increase the awareness. Your business deserves clear goals and processes that will define just how sustainable your business is, will or can be. Fontenot & Associates Solutions LLC, we bring business visions to reality . Click here to schedule your consultation. “Make your team feel respected, empowered and genuinely excited about the company’s mission.” |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed