|

As a business owner, have you ever felt left out of a conversation when others start to talk about their financial statement reports? When you start to hear words such as, P&L, profit and loss, statement of earnings or income statement --- the conversation may start to feel a bit awkward and overwhelming. That’s why we’re going to dive into how to understand more these statements. Understanding the income statement is essential to business owners and investors as it provides an overview of the profitability and future growth of your business. All business owners should see the income statement as a simple and straight forward report on a business’s cash generating ability. It is a scoreboard on the financial performance of your business that reflects when sales are made and expenses are incurred. The official definition says an income statement is: A financial statement generated monthly and/or annually that reports the earnings of a company by stating all relevant revenues (or gross income) and expenses in order to calculate net income. Also referred to as a profit and lost statement. The income statement is one of the five financial statements issued by a business. It reports the amount a corporation has earned during the period between two balance sheet dates. Here are 3 things you should know about an income statement: Income Statements come with Accounting Jargon One thing that can make entrepreneurs shy away from financial statement conversations is the jargon used. The jargon can make it seem more complex than it really is. For example, the term “sales” or “income” might be used instead of revenue. “Expenses” and “costs” are also used interchangeably. “Profit” is sometimes called “net income. Income Statements cover a period of time The income statement reveals how much money your business made over a period of time. Most often, the statement will reflect the performance over a month, a quarter or a year. For example, you might hear the words, year to date, or see “Y-T-D December 31”, indicating the period for Jan 1 to Dec 31. Income Statement follows a formula Every income statement, no matter how complex, follows a very simple formula. Revenue – Expenses = Profit For the period specified on the income statement, it will show the revenue the business earned, the expenses it incurred and the profit it made. If you want to understand how your business operations flows, the income statement can help give you a better picture of what makes your company profitable and where the losses are coming from.

12 Comments

Can you recall the last time you encountered a brain freeze? The thought of Accounting may cause brain freezes for new entrepreneurs but the basics I’m about to share with you will ease the pressure of what Accounting means to your business when getting started.

Here are five ways to understanding Accounting in your business: 1. The business structure must fit It is up to you to choose which kind of structure is best for you and your business, but the importance to the process is not to guess with your selection. This decision matters to the tax structure your business will be obligated to understand and to the amount of paperwork to complete. The most common forms of business are sole proprietorship, partnership, limited liability company (LLC) corporation and S corporation. Each form comes with different tax consequences, you will have to make your selection wisely and choose the structure that best matches your business needs. Below are some of the tax implications to the most common business tax structures:

2. Business activity needs a bank account The ability to maximize your business revenue starts with understanding what is required to be reported. The separation of business income and expenses from personal is by far one of the most important actions to take first. This can be accomplished with the setup of a new bank account exclusively for your business. Many banks offer an introductory period of free banking which could be a few months or longer but it is key to understand what that means for your business after the introductory period. Don’t feel obligated to open a bank account with your current bank, get the best deal and setup for you and your business. In order to open a business account, you’re required to have a business name, which may be a DBA or one of the common business structures formed and registered with your State. Do your research on bank requirement. 3. Budget with the funds you have As a new entrepreneur you may see a budget as a future goal or task for your business but that is far from the truth. You are certainly spending money when starting a new business thus why not understand how much you can truly afford to spend. The first three months of the business can be the most critical time frame to identify how much income is necessary to manage and maintain as well as how much you can afford to spend on business expenses. Allow your budget to be your weekly or monthly resource to understanding your business cash flow. 4. Track your expenses as they occur It’ s one thing to say you are in business and another to develop a habit of consistency to track your expenses. More often than not you may find yourself meeting and building relationships with new clients, traveling to a speaking engagement or replacing supplies with the use of your personal debit banking card or credit card. If you miss capturing these cost, not only will your business pay more tax than necessary but you also do not have a good record of how much your business is costing you. 5. Get paid for your services You are contracted to complete the work, now its time to get paid. Have a payment policy in place which screams “professional” to clients and helps ensure that you and your clients are on the same page right front he outset, says John Rampton, VP from Entrepreneur Magazine. You may also consider offering customers a discount for paying invoices early, can help you get paid more quickly too. For instance, if you usually policy is to have payments due in 30 days, offer a small discount such as two percent to customers who pay within 14 days. You don't have to build your business alone. Allow us to eliminate the brain freezes you or your management team encounter when it come to planning for financial stability and growth. Let's discuss a more efficient way to set your business financially apart! We are scheduling consultations now, email [email protected]. Well, maybe this blog will not make you snuggle up with an Accounting book at night and call it your BFF but I will go for making you two close friends. Close friends because you need this person in your life for your business to be successful. There are millions of small business owners and startup entrepreneurs who are masters at creating products and services and winning over customers. However, many of them are weak in understanding the accounting area of the business. To be effective in grasping the concept of accounting, I find it useful to understand some of the commonly used terminology. Essentially, accounting is about managing debits and credits. Those debits and credit are recorded and managed by the business owner, consultant or bookkeeper of the business, mainly to ensure money is coming into the bank and expenses are being paid timely. The American Accounting Association (AAA) defines accounting as “the process of identifying, measuring and communicating economic information to permit informed judgement and decision by users of the information.” The basic formula to accounting is: Assets = Liabilities + Equity (Owner’s equity)  Knowing the basics equation, outlined above, will assist in the understanding of accounting account types. There are different types of accounts in which debits and credits are kept track of in accounting, let’s define some them,

When managing your business, these definitions will be used quite frequently especially if you have hired a consultant or bookkeeping to manage the accounting area of your business. Let’s say your current business is a hair professional in a Salon and at the end of the day your analyzing how much you made for the day. Your recording book shows:

The owner of the salon may generally record total earned revenues of $175. However, to an accountant or bookkeeper they are also concerned with how much it cost (expenses) the Salon owner to make the two conditioners she sold for $10 each and how much was it to purchase the comb and hair sprays. Understanding this information gives the true net revenue amount of how much the salon owner made for her one day of work. The take away here, is to remember it takes more than developing marketing techniques and creating new products and services to manage a business. As a business owner, your accounting processes and methods used to analyze should be your BFF in the business because without it, you can never know where it stands or how healthy or unhealthy it is. If you understand the importance of accounting to your business and are ready to protect your business from financial risk, visit our website to schedule your consultation. "Success is not final; failure is not fatal: It is the courage to continue that counts." It’s not every day entrepreneurs think about the accounting processes within their business. Accounting is not all about just collecting revenue but more so about the steps it takes to ensure the process to collect money does exist and is clear to the leaders and staff. There are no shortages of details to consider when you’re a small business owner. Getting the back-office basics of accounting in order can make or break a business as it exist in any phase -- start-up, growth or expansion. Let's think about it, fees alone can be “atrocious” thus many experts recommend using an accounting software that will capture all accounting aspects of the business. It is important to pick a software that will suit your business needs not those of a colleague or friend. I say this because what is good for one business owner may not be good for another. However, if you are a business that cannot afford the cost of an accounting software and would rather maintain control in Excel worksheets then it's highly recommended a procedure guide is developed. The guide will provide direction and transparency to an important process within your business. Get your small business in order by starting with these tips:

1. One of the obvious and repeated suggestions is separating business and personal expenses. When it’s time to tally up deductible expenses, you want to be ready. Start today! 2. Understand when it’s time to pay for support. Choosing to hire a consultant or outsource a part of your business process can make a big difference. Not only do you get some of your time back to use on bigger projects you are also investing someone who speaks the professional language in those specific areas. 3. Dedicate time to update your records. Many business owners may choose not to hire a professional consultant to support with updating their accounting records or performing data entry. However, this decision can make a difference in the business. 4. Follow Up on Invoices and Receivables. Many business owners still invoice their customers and wait for payment. It will be key to plan for necessary follow-up calls to ensure the expected revenue remains consistent as budgeted. These accounting tips are all great ways to make small changes. Remember that proper, responsible time management of any task, especially accounting, is key. If you need support to get transition roles, Fontenot & Associates Solutions LLC, can work one to one with you on getting started. When an idea is developed into a business, establishing the accounting processes to track the revenue and expenses is generally not on the top of the list. A chart of accounts short name is (COA) and is defined as “a listing of the names of accounts that a company has identified and made available for recording transactions in its general ledger.” A chart of accounts has standard accounts you may see despite the industry of business you work in. However, typically the order of the accounts are as follows: Balance sheet accounts:

Income statement accounts:

Your account receivables are considered an asset, and so is your income but they are two completely different things. Account receivables are created by the sale of goods or services but income is what you have received from the sale of goods or services. You see, if you bill a customer and give them time to pay it is accounts receivable, and when you receive the money via deposit into your bank account then that is income. Many business owners may be using an accounting software to manage their chart of accounts. The software may provide a list of custom accounts to use but it will be the responsibility of the respective business owner to add custom accounts to ensure finances are recorded accurately. Below is an example of the chart of accounts for a Salon professional: Assets:

Fixed Assets:

Expenses:

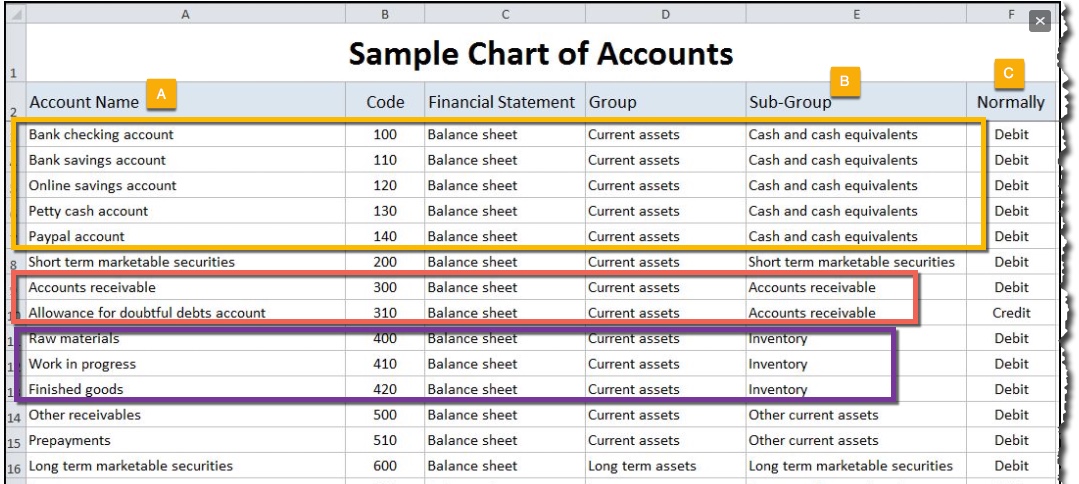

A chart of accounts generally serves as an outline for the business structure and is a tool for gathering and organizing financial information. The chart of accounts example below is one sample guide. It identifies the account name (A), this name will depend on your type of business and sub-group (B), is dividing the chart of accounts into groups for financial representation and normally (C), indicates whether the account is normally increased by a debit entry or credit. For example, depending on the size of business the leader may have one individual responsible for reconciling all of the cash accounts to ensure online, in-store or one-time made purchases are all accounted for on a daily basis. But, in another business the leader may assign cash and accounts receivable to one individual (not recommended, but could happen) and they would be responsible for ensuring all cashed is received and accounted plus for in addition,

The debit and credit column indicates whether the account is normally increased by a debit or a credit. As an example, expense accounts are normally increased by a debit entry but income accounts are increased by a credit. If your looking to strengthen the accounting processes of your business, Fontenot & Associates Solutions LLC has the skills and tools to get you started. Even though your business may be a one person shop, the organization of your finances should be accurate and organized from day one. Getting started is simple, let us show you how. All achievements, all earned riches, have their beginning in an idea. – Napoleon Hill The accounts payable process (also known as A/P) or function is immensely important since it involves nearly all of a company's payments outside of payroll. Regardless of the company's size, the mission of accounts payable is to pay only the company's bills and invoices that are legitimate and accurate. The amount of invoices paid daily within a company will depend on the size and activity.

Key items an Accountant should look for when reviewing invoices are:

Research has identified a few tips related to accounts payable that may allow your business to run a bit smoother.

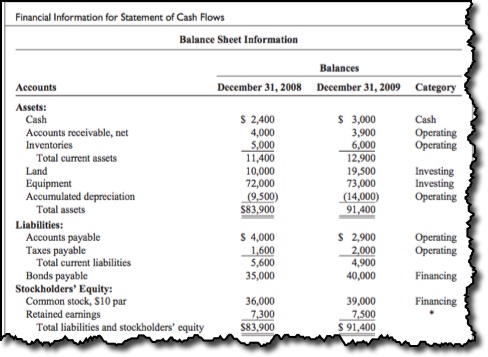

Find more solutions today, Fontenot & Associates Solutions, LLC. “Empower yourself and realize the importance of contributing to the world by living your talent. Work on what you love. You are responsible for the talent that has been entrusted to you.” Cash inflows and outflows are determined by analyzing all balance sheet accounts other than the cash and cash equivalent accounts. The following account balance changes indicate cash inflows:

Cash outflows are indicated by the following account balance changes:

As an Accountant it is important to remember that three techniques may be used to prepare the statement of cash flows:

Continue to grow in your professional role and don't be afraid to share that knowledge with your team! Accounting Treatment in the Oil & Gas Industry“Make your team feel respected, empowered and genuinely excited about the company’s mission.” As an Accountant in the Oil and Gas industry, you may spend a great deal of time analyzing accounting data, reconciling general ledger accounts and trying your hardest to listen very close in meetings as you try to figure out the many acronyms that are flying around in converstations. I'm here to encourage you to not be afraid to ask those questions. The way I see it, the more you know about your role the bigger the contribution is to the team. The process in which production cost is incurred generally ties back to the maintenance or opportunity to increase production activities on a well. After a well has been completed, and flow lines, heater treaters, separators, storage tanks, etc., have been installed, production activities begin. If you are an accounting professional presently working within the industry all of the production expenses are key to cost control for producers and operators. Production activities involve lifting the oil and gas to the surface and then gathering, treating, processing, and storing the oil and gas. Production cost is defined as those cost incurred to operate and maintain an enterprise's wells and related equipment and facilities, including depreciation and applicable operating costs of support equipment and facilities and other cost of operating and maintaining those wells and related equipment and facilities. They become part of the cost of oil and gas produced. The accounting role you are in today speaks volumes because your skills and knowledge matters for many reasons. What remains important in an accounting role, undeniably, starts with understanding your industry and this process is generally a hands on learning curve? But this learning curve should not keep the accountant from showing initiative and inquiring from management when an assigned task is unclear. Production cost has it's challenges because the accountant must be aware of how cost is attributable to wells, directly or allocated. Here are some examples of production-related cost and how cost are assigned: Directly Attributable Costs:

These examples are just a few of what an accountant must consider in their roles each day. When investing in companies involved in the exploration and development of oil and natural gas reserves, company analysis should include recognizing which accounting method a company follows. The development of extensive policies and procedures can support the professional accountants and managerial team with monthly responsibilities and meeting company expectations. Source: Fundamentals of Oil and Gas Accounting

“Ideas are easy. Implementation is hard.” – Guy Kawasaki, co-founder Alltop Let's assume that you have been getting away with creating or maintaining a budget thus far and see no need to make the additional time and create one. But, what about the two o'clock meeting next week you have with a potential partner or investor? How will you show them the potential growth of your company? A budget is a great way to display your businesses objectives and goals to a third party. So, why wouldn't you take the time to create an exercise this important?

Research shows the primary benefits of budgeting have been identified as follows:

Fontenot & Associates Solutions LLC can develop an extensive guide for your key Accountant, to ensure the development and detail support for the budget is accurate. A budget is only as accurate as the data used. Visit our website today to schedule your consultation - today! The life of a business owner brings along the duty to wear many hats each day. Just think, you must juggle the ideas of new projects, the color selection of your office, customer service, the business attire culture, marketing and of course the finances of your business. Finances are the critical aspect of your business and everything else follows suit, wouldn't you agree. If the finances are not managed, reviewed, outlined and budgeted the day to day operations will be a bit more challenging to sustain in a competitive market. Now is a great time to learn more about budgeting and expand on the basics of what it really means to a business minded individual just like you. Budgeting has been a way of life for many of us. Think back -- as a student, you budgeted your study time and your money. Governmental agencies budget revenues and expenditures. Businesses use budgets in planning and controlling their operations. Through budgeting, it should be possible for management to maintain enough cash to pay creditors, to have sufficient raw materials to meet production requirements, and to have adequate finished goods to meet expected sales. A budget is defined a formal written statement of management's plans for a specified future time period, expressed in financial terms. It is known to represent the primary method of communicating agreed-upon objectives throughout the organization. It promotes efficiency and serves as a deterrent to waste and efficiency. Accounting information makes major contributions to the budgeting process. Just think, from the accounting records companies can obtain historical data on revenues, costs, and expenses. These forms of data are helpful in formulating future budget goals. It is time to ask yourself as a business owner, how you plan to measure success? How will you plan ahead for the business? The budget itself, and the administration of the budget, however, are entirely management responsibilities. A great start to the success of this process is by establishing an extensive policy and procedures guide to ensure those responsible for gathering the details of what management needs for reporting and compliance is accurate and retrievable. It is never to late to get started! Success is in the eye of the beholder and Fontenot & Associates Solutions LLC is available to get you started. Visit our website today and join our mailing list to ensure your getting the information you need directly into your inbox. “Success is walking from failure to failure with no loss of enthusiasm.” – Winston Churchill |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed