|

When an idea is developed into a business, establishing the accounting processes to track the revenue and expenses is generally not on the top of the list. A chart of accounts short name is (COA) and is defined as “a listing of the names of accounts that a company has identified and made available for recording transactions in its general ledger.” A chart of accounts has standard accounts you may see despite the industry of business you work in. However, typically the order of the accounts are as follows: Balance sheet accounts:

Income statement accounts:

Your account receivables are considered an asset, and so is your income but they are two completely different things. Account receivables are created by the sale of goods or services but income is what you have received from the sale of goods or services. You see, if you bill a customer and give them time to pay it is accounts receivable, and when you receive the money via deposit into your bank account then that is income. Many business owners may be using an accounting software to manage their chart of accounts. The software may provide a list of custom accounts to use but it will be the responsibility of the respective business owner to add custom accounts to ensure finances are recorded accurately. Below is an example of the chart of accounts for a Salon professional: Assets:

Fixed Assets:

Expenses:

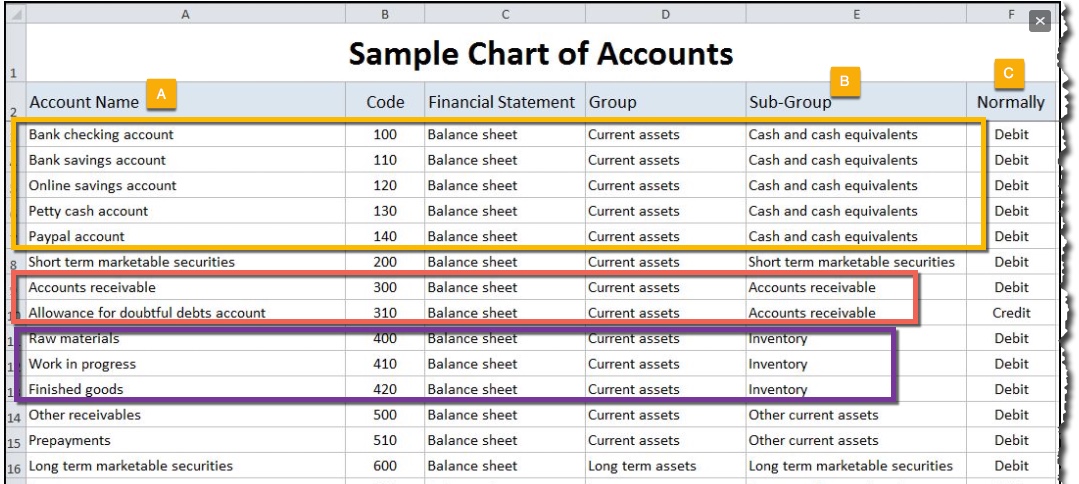

A chart of accounts generally serves as an outline for the business structure and is a tool for gathering and organizing financial information. The chart of accounts example below is one sample guide. It identifies the account name (A), this name will depend on your type of business and sub-group (B), is dividing the chart of accounts into groups for financial representation and normally (C), indicates whether the account is normally increased by a debit entry or credit. For example, depending on the size of business the leader may have one individual responsible for reconciling all of the cash accounts to ensure online, in-store or one-time made purchases are all accounted for on a daily basis. But, in another business the leader may assign cash and accounts receivable to one individual (not recommended, but could happen) and they would be responsible for ensuring all cashed is received and accounted plus for in addition,

The debit and credit column indicates whether the account is normally increased by a debit or a credit. As an example, expense accounts are normally increased by a debit entry but income accounts are increased by a credit. If your looking to strengthen the accounting processes of your business, Fontenot & Associates Solutions LLC has the skills and tools to get you started. Even though your business may be a one person shop, the organization of your finances should be accurate and organized from day one. Getting started is simple, let us show you how.

0 Comments

Leave a Reply. |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed