|

The world of filming offers a dream career for many people. Film production is one of the few nationally subsidized media businesses in the United States. As a business owner, how are you planning for company success? And as an entrepreneur how will your business services be unique to the industry? Planning for success in any industry starts with a business plan that includes short-term and long-term goals. To start a film in production company you will need to incorporate or become an LLC. Once you have incorporated you will need to come up with a script, either by writing it or finding one you want to produce. Some states offer grants for filming in their areas, but grants will not keep your business moving so you must consider other options for funding. Topics such as funding should be outlined in detail within your business plan. When developing a business plan be prepared to incorporate the expected challenges the industry may bring such as taxation, hiring staff and making the proper connections. Will you bring a partner onboard and if so at what phase of the business? How will you and the business partner mingle funds into the business. These are questions I encourage you as an entrepreneur to consider before the days turn into months and the months turn into years. The Houston Chronicle published a great article about getting started, check it out. Below are additional links to use in learning more about the industry: Fontenot & Associates Solutions LLC can support your start-up budget plan or business plan.

8 Comments

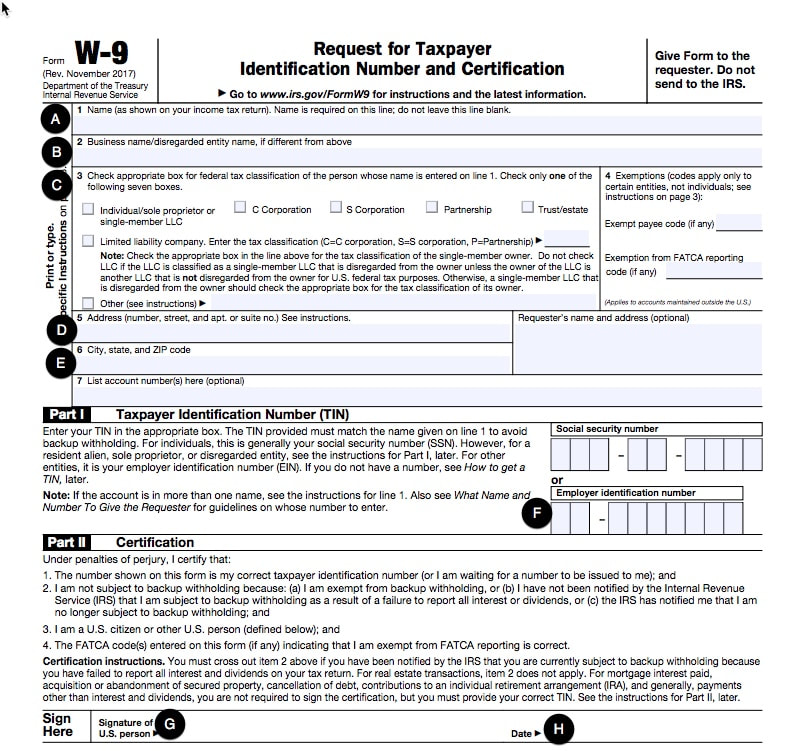

The IRS Form W-9 is important for small business owners. You will need this whenever you hire an independent contractor for your business. It’s a good idea to have all independent contractors complete this form before you pay them.

As a company you will use the information provided by the independent contractor to prepare the Form 1099-MISC, reporting to the Internal Revenue Service the amount of income that was paid to the independent contractor by your company. The W-9 form also contains boxes to check showing how the contractor’s business is legally organized. This includes sole proprietor, C Corporation, S Corporation, Partnership, or Limited Liability Company. When contractors sign the W-9, they certify under penalty of perjury that they have completed the form correctly. They also certify they are not subject to backup withholding and are a U.S. citizen. The IRS states that anyone that receives payment of $600 or more over the course of a tax year needs to fill out the Form W-9. The best rule in practice is to collect the form anytime you pay someone for anything, even if it’s below the $600 threshold. The Form W-9 does not have to be filed with the IRS. It will be important to maintain the signed form in your files. Completing Form W-9 is pretty straightforward. The contractor should just indicate the business name and their employer identification number (EIN), also known as the tax ID number. When the form is completed, the contractor is certifying to the IRS that the tax ID number being provided is correct and accurate. When running your own business you may have to hire independent contractors and this process requires you to track and maintain files in order to run an effective and compliant business. Make no mistake, your business staff and management team should have a clear understanding of what the W-9 form is and when to use it. Building a business includes more than just picking a location, developing a business plan, building a website or picking your social media platform. Some of you may be asking what could be more important. Well, I'm here to tell you that opening a business bank account should be on your top 5 of "things to do" list. Having a business checking account can help you deal with tax, legal and practical issues. Many business owners choose to manage their business and personal finances within the same bank account for the purpose of convenience and but fail to realize the advantages that come with managing a separate business account. A major reason that companies use bank accounts is for internal control. Here are a couple of the control advantages of using bank accounts:

Keep in mind, the Internal Revenue Service (IRS) is really picky about business owners being able to show that their business is really a business and not a hobby. Basically, you have to show a profit on Federal Tax Form Schedule C three years out of every five. Having a separate business bank account established further proves you are a business and not a hobby business. As your business grows, it becomes critical to build a proper legal and financial foundation. Opening a separate bank account is one small step in that direction, and will help keep your accounting records organized.

Acquiring new customers is expensive and time-consuming. As a matter of fact, research shows that attracting new customers is 5X more expensive than keeping your existing customers. One of the most effective ways to increase your revenue is to invest more time with your existing customers. In the early stages of building your business, you use marketing to attract new customers. Once you land a steady flow of customers, your work has just begun. As a small business owner, you need to keep customers coming back. This is why marketing to existing customers is essential for your small business. Don’t let customer relationships fizzle out after the first sale. We have identified four methods you can use to invest more into your existing customers and to help keep them coming back. Tip 1: Stay in Contact Most of the time, your customers are not at your business. It’s important to stay visible by building brand awareness and marketing when you customers are not around. Tip 2: Address customer needs When you operate as a small business, you have an advantage over the larger corporations by offering a personal experience. What problems can your business solve for existing customers? Find out what the customer expects as soon as possible. Ask open-ended questions during your earliest conversations and listen to understand customer perception. Open-ended questions are those that require something more than just a simple "yes" or "no" in response. Tip 3: Collect data Data is gold when it comes to marketing to existing customers. You can use data to personalize marketing strategies for current customers. Find out your customers’ opinions by collecting feedback. For example, you could send a follow up email to a customer to ask if they are satisfied with your product or service. Have a place where customers can submit feedback. Also, set up a process to let customers know how you fill use feedback. Tip 4: Add Complementary Services to Existing Products Adding complimentary services or products may help you gain new clients, as well as maintain existing ones. Review the products of your competitors for ideas. Tip 5: Set up a loyalty program A loyalty program rewards existing customers for returning to your business. Creating a loyalty program also connects customers to your business. A loyalty program rewards customers for buying from your business. Set up a loyalty program for your business to encourage customers to keep coming back. Since they draw current customers back to your business, loyalty programs increase your revenue while rewarding customers. These are just a few tips on how to get more revenue from your existing customers. By implementing these simple tips, you will soon see opportunities you can use to develop or enhance your customer service policies and procedures. The best part about reflecting on your existing processes, is that your customers will benefit and feel that they are appreciated. Make this a focus of your marketing efforts and you will soon see the rewards come back in the form of increased referrals and increased sales. I don't know about you but this tax season seems to be moving at an accelerated pace. However, we don't want you to move too fast that you miscalculate your taxable income, incidentally under report your business income or miss an important tax deadline. Fontenot & Associates Solutions, LLC has identified five (5) avoidable, but yet common small business tax pitfalls to share with you as we look for ways to help minimize your business expenses. We prefer that you keep any extra dollars earned in your bank account. 1. Making Deduction Mistakes - One of the most common mistakes made by small business owners is, not keeping accurate records of their expenses. While some may see it as a tedious task, Fontenot & Associates Solutions, LLC would like you to see it as taking the initiative to avoid spending countless dollars on penalties to the IRS. 2. Charity Donation Pitfalls - Charity donations should not be your go to deduction when trying to reduce your taxable income. If you donate to charity, you will need to keep an accurate list of the items donated and its value. In addition, obtain a receipt from the location, which should be a reputable one. This will help to avoid a 25 percent penalty. 3. Inaccurate Tax Returns - If you made an error on your tax return that results in you owing more tax, the IRS can charge you a late payment penalty on the amount still owed. This could be a costly mistake for m any small business owners, especially since the penalty is 0.5 percent per month or partial month, to a maximum of 25 percent of the amount owed. A recommended solution to this tax pitfall is to review your business transactions at least quarterly for accuracy.

4. Failing to Making a Payment on Time - While some of these pitfalls may not be intentional, it does not stop the IRS from penalizing you and assessing a 0.5 to 1 percent penalty each month on an unpaid tax bill. 5. Civil Fraud Pitfalls - A huge pitfall a small business owner can make is to underreport income with fraudulent intent. Not reporting all of the income earned on your federal tax return, on purpose, can cost you not only huge penalties but also a charge for criminal tax fraud. The penalties fined can be as much as 75 percent of the amount you failed to report. This pitfall is not one to take lightly and is completely avoidable with the proper business processes in place. The solution to all of these pitfalls, starts with keeping accurate records. Small business owners may also consider hiring a professional to support them and/or their team. Remember, you are in business to build and grow. An audit has caused many small businesses to close their doors because of underreported income or high penalties for fraud - this does not have to be your business. We are here to support! I have not failed. I've just found 10,000 ways that won't work - Thomas Edison Today in your business, the day to day responsibilities may be moving like a bright beam of light in the sky. Fast. It may be so fast that some weeks your to-do list for the business can appear duplicated because you have not been able to manage the workload and thus prior week’s task gets moved into a new week. The question then becomes, why? In many cases, it’s not because the task is hard to complete but more so because you did not have the visual reminder that a needed task was to be accomplished. When a checklist is used with operational processes and procedures, checklists can promote standardized work performance to help reduce variances; thus, reducing errors and costs leading to an increase in profits. The key to developing checklist is not to include every single item you can think of for your staff or employee to complete - remember, they are professionals in their fields. The goal is to provide a resource of reminders to the most critical and important steps, many times all of what a professional and/or expert needs, even the most highly skilled. If you think about the industries who presently use them heavily, you may think of healthcare, childcare and crime scene investigators just to name a few. These industries are filled with highly skilled professionals but having a checklist to accompany their day to day responsibilities can literally save lives. They can also do the same for your business. When launching a business, your brain switches gears into overdrive mode because you become so keened finding your ideal clients and building the business. As you think about what’s next for your business, don’t forget that the products and services you are developing, marketing and branding are saving lives for individuals and business owners everyday. Thus, your focus should be to implement the proper tools within your business that will allow you to avoid the most common glitches by incorporating checks and balances. Think back to the day you decided to kick-start your own business. The adrenaline was high and the “list of must do” items on your business list was overwhelming to say the least. How great would it have been to have resource tools , such as a checklist, to accompany you through those moments and days of confusion and frustration on what should be your key focus for a few hours, a day or even a week?

Using checklist and your business “to-do list” allows you to schedule activities and not let anything fall through the cracks. So, if you do something time and time again on a daily basis, and you want to do it right every time, create a checklist. In his white paper “Use This Checklist or People Die!”, Jacobson provides this checklist for creating your ideal checklist: A. Target areas that are under-performing. B. Establish a benchmark for improvement. C. Document the sequence of tasks for each involved. D. Prioritize each task and identify those that are essential. E. Identify every area where a decision is made or judgment is required. F. Implement a checklist and measure results. G. Create a checklist for future edits – don’t assume you will get it right the first time. Checklist, whether simple or complex have been identified as great tools to improve effectiveness and efficiency. If you feel like you or your employees could do more to optimize their time each day - create a checklist. Can your business use a checklist? Sure it can. Take action today and schedule your consultation with Fontenot & Associates Solutions, LLC today. |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed