|

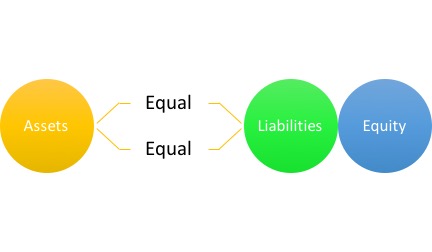

Well, maybe this blog will not make you snuggle up with an Accounting book at night and call it your BFF but I will go for making you two close friends. Close friends because you need this person in your life for your business to be successful. There are millions of small business owners and startup entrepreneurs who are masters at creating products and services and winning over customers. However, many of them are weak in understanding the accounting area of the business. To be effective in grasping the concept of accounting, I find it useful to understand some of the commonly used terminology. Essentially, accounting is about managing debits and credits. Those debits and credit are recorded and managed by the business owner, consultant or bookkeeper of the business, mainly to ensure money is coming into the bank and expenses are being paid timely. The American Accounting Association (AAA) defines accounting as “the process of identifying, measuring and communicating economic information to permit informed judgement and decision by users of the information.” The basic formula to accounting is: Assets = Liabilities + Equity (Owner’s equity)  Knowing the basics equation, outlined above, will assist in the understanding of accounting account types. There are different types of accounts in which debits and credits are kept track of in accounting, let’s define some them,

When managing your business, these definitions will be used quite frequently especially if you have hired a consultant or bookkeeping to manage the accounting area of your business. Let’s say your current business is a hair professional in a Salon and at the end of the day your analyzing how much you made for the day. Your recording book shows:

The owner of the salon may generally record total earned revenues of $175. However, to an accountant or bookkeeper they are also concerned with how much it cost (expenses) the Salon owner to make the two conditioners she sold for $10 each and how much was it to purchase the comb and hair sprays. Understanding this information gives the true net revenue amount of how much the salon owner made for her one day of work. The take away here, is to remember it takes more than developing marketing techniques and creating new products and services to manage a business. As a business owner, your accounting processes and methods used to analyze should be your BFF in the business because without it, you can never know where it stands or how healthy or unhealthy it is. If you understand the importance of accounting to your business and are ready to protect your business from financial risk, visit our website to schedule your consultation.

0 Comments

Leave a Reply. |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed