Don't Be Confused About the Importance of Reconciling AccountsWhen I speak to small business owners about account reconciliations I often get the look of, my business does not need that. But, as a small business owner do at least have an idea of when you may need it? Is it documented in your business plan of when you will execute the process and train your assistant or staff on how to complete the task? These are the questions I would like many small business owner who are busy with building their business to consider and think about for a moment. I would like to share a great example of a standardized process I read recently in an article published by Journal of Accountancy, which was golf courses. Can you imagine the chaos that would exist if holes weren't numbered and golfers could choose to play any hole they wanted at any time? The same holds true with a company's account reconciliation process. In our August 2016 "Fontenot News", we share our knowledge, research and identify the importance of account reconciling for your business. Enjoy it! I encourage you to share it with one of your colleagues today and increase the awareness. Your business deserves clear goals and processes that will define just how sustainable your business is, will or can be. Fontenot & Associates Solutions LLC, we bring business visions to reality . Click here to schedule your consultation. “Make your team feel respected, empowered and genuinely excited about the company’s mission.”

1 Comment

Yes, They Are Key to The Workplace!Analytical skills are in high demand from organizations and should be a development tool for business owners and professionals. Analytical thinking skills allow us to gather information, articulate and solve complex problems. ''Study's have shown 58% of company leaders say analytics are important to their organizations now, and 82% say they will be important in 5 years.'' This study was published in 2013 but is very much relevant for our today and future professionals. "Research shows, if you worry that your analytical skills are not up to par, never fear. They can be developed with time and consistent practice. Like a muscle, the more you use it, the stronger it gets. One way to start is to read more books. This may sound a little too simple of a solution but it really works. How does it work? Well, it helps when you read as actively as possible. Instead of passively skimming over paragraphs and grazing the pages, try to look at both sides of the story. For example, if you are reading a novel, try to see the plot from the perspective of the hero, the villain and other supporting characters. This causes your brain to think in new ways, and increase your stimulation. Thinking differently helps to expand your mind, which is critical. Another excellent option is to build your mathematical skills. Calculus, algebra and statistics all make use of logic and analysis. You need to go through each problem step-by-step in order to come up with the right answer. Sometimes, you have to work a problem multiple times before you finally figure it out. This can be frustrating, but you get better with focused practice. You can also work through different puzzles with the goal of solving them." As a reminder to management of corporations, entrepreneurs and business owners who have staff or plan to build a staff - If staff does not understand the basics of their job it will make their job even harder. Fontenot & Associates Solutions can support with the development of policies and procedures, visit our webpage www.FontenotSolutions.com. Source: Dailytenminures

Do You Need to Strengthen your Supporting detail?Supporting documentation provides detail for and substantiates the general ledger balance being reconciled. Supporting documentation should be detailed enough so that a person with no extensive knowledge of the account can review the reconciliation and understand the nature of the balance. Examples of supporting documentation include, but are not limited to, bank or other third party statements. While the description lines for most journals have a limited number of characters, Management should give more attention to the comments and explanations being provided by the accountant for reasons of audit and future reference. Avoid high level explanations, these are the ones we tend to forget why the journal was posted when we reference back months later. Source: VanderbiltUniversity

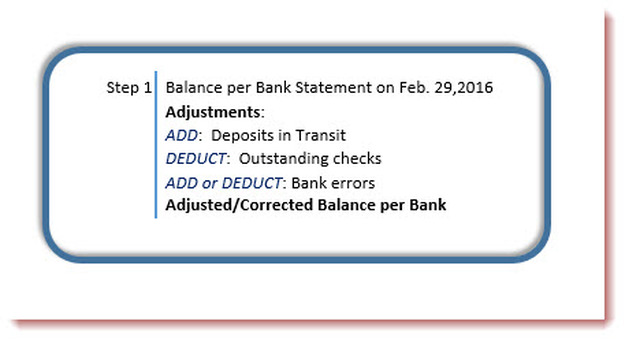

Adjusting the Balance Per BankThe first step of the bank reconciliation process is to adjust the "balance on the bank statement" to the true, adjusted, or corrected balance. Below is the formula for obtaining the balance. What are deposits in transit? Those are the amounts already received and recorded by the company, but are not yet recorded by the bank. Your outstanding checks are identified as the checks written and recorded in the company's cash account but NOT yet cleared the bank - this delay can be related to timing of when the check was presented to your bank for payment and the time of occurrence. Instances such as theses will be potential adjustments to an Accountants monthly bank reconciliation.

Continue to follow the blog for more information regarding bank reconciliations.

Source: Accounting Coach

Desire is the key to motivation, but it’s determination and commitment to an unrelenting pursuit of your goal — a commitment to excellence — that will enable you to attain the success you seek.”–Mario Andretti Performing monthly balance sheet account reconciliations are critical not just for management but also the accountants responsible. It can be a tedious assignment and it requires critical thinking and well outlined explanations to ensure management can feel confident about the balances. Here a 4 key tips for reconciliations:

Act as if what you do makes a difference. It does." - William James

The key to reconciling is, start!

|

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

||||||||

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed