|

The IRS Form W-9 is important for small business owners. You will need this whenever you hire an independent contractor for your business. It’s a good idea to have all independent contractors complete this form before you pay them.

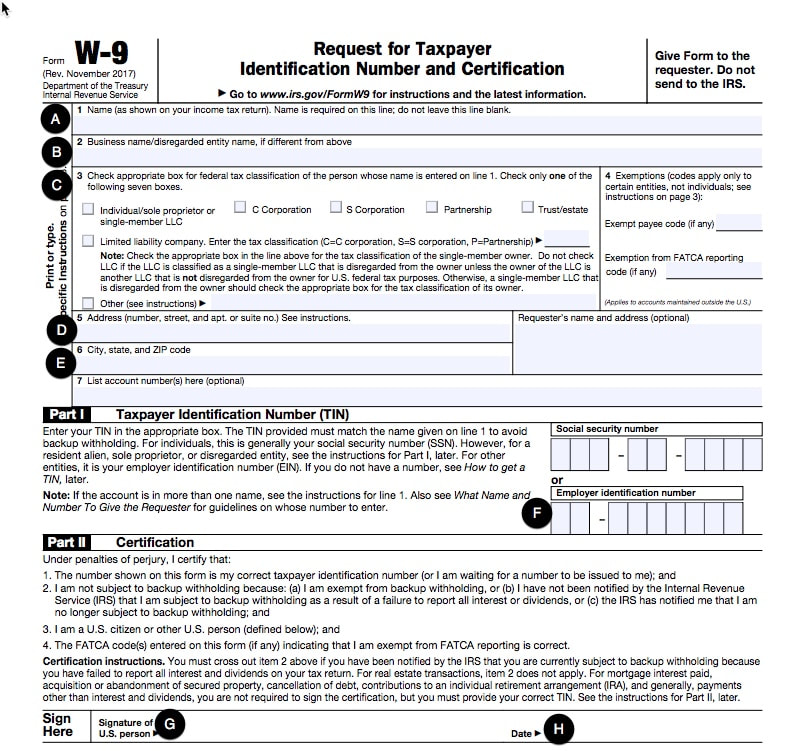

As a company you will use the information provided by the independent contractor to prepare the Form 1099-MISC, reporting to the Internal Revenue Service the amount of income that was paid to the independent contractor by your company. The W-9 form also contains boxes to check showing how the contractor’s business is legally organized. This includes sole proprietor, C Corporation, S Corporation, Partnership, or Limited Liability Company. When contractors sign the W-9, they certify under penalty of perjury that they have completed the form correctly. They also certify they are not subject to backup withholding and are a U.S. citizen. The IRS states that anyone that receives payment of $600 or more over the course of a tax year needs to fill out the Form W-9. The best rule in practice is to collect the form anytime you pay someone for anything, even if it’s below the $600 threshold. The Form W-9 does not have to be filed with the IRS. It will be important to maintain the signed form in your files. Completing Form W-9 is pretty straightforward. The contractor should just indicate the business name and their employer identification number (EIN), also known as the tax ID number. When the form is completed, the contractor is certifying to the IRS that the tax ID number being provided is correct and accurate. When running your own business you may have to hire independent contractors and this process requires you to track and maintain files in order to run an effective and compliant business. Make no mistake, your business staff and management team should have a clear understanding of what the W-9 form is and when to use it.

6 Comments

3 Top Benefits to Outsourcing For Small BusinessesWhile you might think that only large and multinational corporations - can benefit from outsourcing, small businesses can potentially realize even bigger outsourcing benefits because of how many new jobs are actually being created within smaller companies. According to the Small Business Administration, companies with less than 500 employees account for almost 65 percent of new private sector employment.

Outsourcing refers to the way in which companies entrust the processes of their business functions to external vendors or small businesses. There are many benefits of outsourcing your business processes.

|

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed