|

Cash doesn’t always flow how you need it to. It can start from customers who pay late to suppliers who have suffered some setbacks. Building a cushion in your bank account isn't a complicated concept; instead of having just enough to pay bills and staff, it is time to have a more significant amount in the account. An amount that will not only allow for timely payments of monthly billings but enough to transfer into savings. Maintaining a smooth cash flow requires juggling many aspects of the business, such as staying on top of “pending cash,” also known as accounts receivable.

Cash flow is the life of an organization; it’s a means to pay salaries, buy supplies and make stock investments. As the statistics have shown, owners who cannot efficiently manage their business cash flow are almost certain to fail. To improve cash flow and sustain growth, it will be important to build a cash cushion. Cash reserves enable companies to cope with business disruption, deal with seasonality, and manage slow-paying customers. In addition, it allows a business to take advantage of new opportunities should they arise, and plan for future growth by having investment capital available. Here are just a few tips on how business owners can boost their cash flow:

The efforts to implement meaningful business changes will be a combination of lessons learned. Building and keeping an adequate accumulation of cash provides maximum opportunity and flexibility to any business. Fontenot & Associates Solutions, LLC recommends identifying the method or strategies which work for your business culture. Building a stable long-term business means having sufficient liquidity and a developed and executed form of policy and procedures with clarity defined goals.

6 Comments

Are you a small business planning to offer benefits to your current staff or new employees? Since small businesses often don’t have big budgets to compete with bigger companies on salary, offering employee perks is one way to help bridge the gap, boost morale and improve employee retention rates.

Many experts and entrepreneurs have identified some of the best perks that small businesses can offer employees.

The world of filming offers a dream career for many people. Film production is one of the few nationally subsidized media businesses in the United States. As a business owner, how are you planning for company success? And as an entrepreneur how will your business services be unique to the industry? Planning for success in any industry starts with a business plan that includes short-term and long-term goals. To start a film in production company you will need to incorporate or become an LLC. Once you have incorporated you will need to come up with a script, either by writing it or finding one you want to produce. Some states offer grants for filming in their areas, but grants will not keep your business moving so you must consider other options for funding. Topics such as funding should be outlined in detail within your business plan. When developing a business plan be prepared to incorporate the expected challenges the industry may bring such as taxation, hiring staff and making the proper connections. Will you bring a partner onboard and if so at what phase of the business? How will you and the business partner mingle funds into the business. These are questions I encourage you as an entrepreneur to consider before the days turn into months and the months turn into years. The Houston Chronicle published a great article about getting started, check it out. Below are additional links to use in learning more about the industry: Fontenot & Associates Solutions LLC can support your start-up budget plan or business plan.

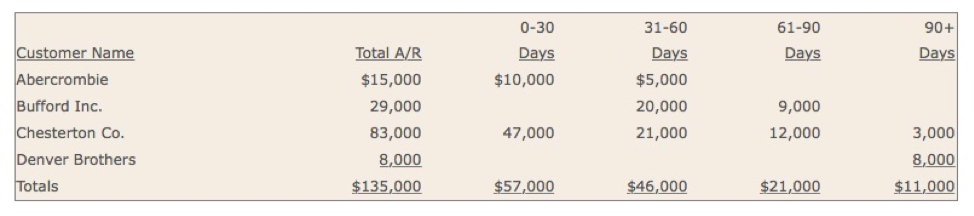

For many small business owners, extending credit to customers seems like a no-brainer since it can be a great way to attract customers and build profitable long-term relationships with them. Credit is convenient and will probably win customers, but sales revenue will be delayed for either the discount period or the credit period, or perhaps longer if the customer is late in making the payment. Business owners and those responsible for the day to day task should understand that the analysis of receivables method is based on the assumption that the longer an account receivable is outstanding, the less likely that it will be collected. Accounts receivable constitute the primary source of incoming cash flow for most businesses, so you should analyze these invoices in aggregate to ascertain the health of the underlying cash flows. The analysis of receivable method is applies as follows: Step 1: The due date of each account receivable is determined Step 2: The number of days each account is past due is determined. This is the number of days between the due date of the account and the date of the analysis. Step 3: Each account is placed in an aged class according to its days past due which is typically aged as follows:

Step 5: The total for each aged class is multiplied by an estimated percentage of uncollectible accounts for that class Step 6: The estimated total of uncollectible accounts is determined as the sum of the uncollectible accounts for each ages class. The preceding steps include summarizing an aging schedule and this overall process is called aging the receivables. An example of a business’s aging report is provided below. A detailed process such as accounts receivable should be an extensive documented process for any business. This process will ensure cash flow is managed appropriately by those responsible. Fontenot & Associates Solutions LLC can support with the development and analytical process of the monthly accounts receivable, we are just a click away.

When the time comes to invest back into your business, one the biggest steps you will take as a small business is hiring your first employee. Where many small business owners’ lose sight of this important consideration is the true value and long-term value this course of action can have on their business.

Yes, hiring your first employee will increase your weekly or monthly cost because now you have more responsibilities and commitments to your employee. You are now on the hook to pay another person a salary weekly, bi-weekly or monthly despite the success of the business. Hiring support opens doors and many new opportunities for growth. The day to day responsibilities of entrepreneurship can leave you guessing when it comes to what you need for tax season. Tax time is never that much fun so, this year, make sure you don’t leave out any crucial information.

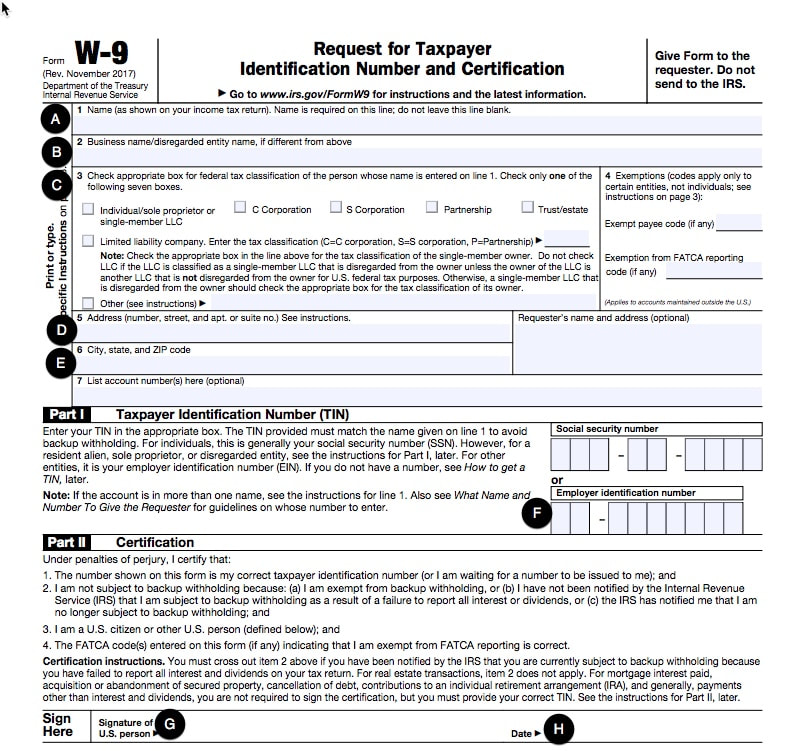

You can start now with a simple checklist: 1. File the correct tax form Sole proprietors and single-member LLCs report business income and expenses on Schedule C that is attached to your Form 1040 Individual Tax Return. If your business is a partnership or multi-member LLC, you’ll be required to report business income and expenses on Form 1065. S corporations report business activity on Form 1120-S. Then the partnership, LLC or S corporation issues a Schedule K-1 to its shareholders, reporting their share of the entity’s income, deductions, and credits. 2. Provide business information When preparing to file your annual tax return, you will need to provide some basic information, including your business legal name, social security number, and address. If you have filed for an Employer Identification Number (EIN) with the IRS for your business, you will need it as well. If addition, make sure the name on your tax return matches the name on file with the Social Security Administration – otherwise, it can cause a delay with your refund. 3. Get your receipts out of the box Keeping your accounting records in order throughout the year can make it a lot easier to prepare your annual tax return. If you have a professional tax preparer or accountant, one of the first things they will ask you for is your bookkeeping records, such as your journal entries, list of revenue and expenses, bank and or credit card statement, profit and loss statement and balance sheet. 4. Understand the Home Office deduction One very common business deduction for small business owners involves the home office deduction. You may be eligible if you use your home regularly and exclusively for business. You can find the full instructions for Form 8829, Expenses for Business Use of Your Home, for more details on whether you qualify. 5. Be clear on deductions for your business vehicle Another common deduction associated with small business owners is car expenses. It is important that if you drive your own car, you need to keep an accurate log of your mileage for business use. The IRS will not allow a deduction for business use of a vehicle without a record of miles driven for business. Your log may be kept manually or electronically. The IRS Form W-9 is important for small business owners. You will need this whenever you hire an independent contractor for your business. It’s a good idea to have all independent contractors complete this form before you pay them.

As a company you will use the information provided by the independent contractor to prepare the Form 1099-MISC, reporting to the Internal Revenue Service the amount of income that was paid to the independent contractor by your company. The W-9 form also contains boxes to check showing how the contractor’s business is legally organized. This includes sole proprietor, C Corporation, S Corporation, Partnership, or Limited Liability Company. When contractors sign the W-9, they certify under penalty of perjury that they have completed the form correctly. They also certify they are not subject to backup withholding and are a U.S. citizen. The IRS states that anyone that receives payment of $600 or more over the course of a tax year needs to fill out the Form W-9. The best rule in practice is to collect the form anytime you pay someone for anything, even if it’s below the $600 threshold. The Form W-9 does not have to be filed with the IRS. It will be important to maintain the signed form in your files. Completing Form W-9 is pretty straightforward. The contractor should just indicate the business name and their employer identification number (EIN), also known as the tax ID number. When the form is completed, the contractor is certifying to the IRS that the tax ID number being provided is correct and accurate. When running your own business you may have to hire independent contractors and this process requires you to track and maintain files in order to run an effective and compliant business. Make no mistake, your business staff and management team should have a clear understanding of what the W-9 form is and when to use it. 3 Top Benefits to Outsourcing For Small BusinessesWhile you might think that only large and multinational corporations - can benefit from outsourcing, small businesses can potentially realize even bigger outsourcing benefits because of how many new jobs are actually being created within smaller companies. According to the Small Business Administration, companies with less than 500 employees account for almost 65 percent of new private sector employment.

Outsourcing refers to the way in which companies entrust the processes of their business functions to external vendors or small businesses. There are many benefits of outsourcing your business processes.

Building a business includes more than just picking a location, developing a business plan, building a website or picking your social media platform. Some of you may be asking what could be more important. Well, I'm here to tell you that opening a business bank account should be on your top 5 of "things to do" list. Having a business checking account can help you deal with tax, legal and practical issues. Many business owners choose to manage their business and personal finances within the same bank account for the purpose of convenience and but fail to realize the advantages that come with managing a separate business account. A major reason that companies use bank accounts is for internal control. Here are a couple of the control advantages of using bank accounts:

Keep in mind, the Internal Revenue Service (IRS) is really picky about business owners being able to show that their business is really a business and not a hobby. Basically, you have to show a profit on Federal Tax Form Schedule C three years out of every five. Having a separate business bank account established further proves you are a business and not a hobby business. As your business grows, it becomes critical to build a proper legal and financial foundation. Opening a separate bank account is one small step in that direction, and will help keep your accounting records organized.

It’s not every day entrepreneurs think about the accounting processes within their business. Accounting is not all about just collecting revenue but more so about the steps it takes to ensure the process to collect money does exist and is clear to the leaders and staff.

There are no shortages of details to consider when you’re a small business owner. Getting the back-office basics of accounting in order can make or break a business as it exist in any phase -- start-up, growth or expansion. Let's think about it, fees alone can be “atrocious” thus many experts recommend using an accounting software that will capture all accounting aspects of the business. It is important to pick a software that will suit your business needs not those of a colleague or friend. I say this because what is good for one business owner may not be good for another. However, if you are a business that cannot afford the cost of an accounting software and would rather maintain control in Excel worksheets then it's highly recommended a procedure guide is developed. The guide will provide direction and transparency to an important process within your business. Get your small business in order by starting with these accounting tips: 1. One of the obvious and repeated suggestions is separating business and personal expenses. Open the business bank account as soon as you start accepting or spending money on the business. When it’s time to tally up deductible expenses, you want to be ready. Start today! 2. Understand when it’s time to pay for support. Choosing to hire a consultant or outsource a part of your business process can make a big difference. Not only do you get some of your time back to use on bigger projects you are also investing someone who speaks the professional language in those specific areas. As a new business, your time matters! 3. Dedicate time to update your records. Many business owners may choose not to hire a professional consultant to support with updating their accounting records or performing data entry. However, this decision can make a difference in the business. 4. Follow Up on Invoices and Receivables. Many business owners still invoice their customers and wait for payment. It will be key to plan for necessary follow-up calls to ensure the expected revenue remains consistent as budgeted. These accounting tips are all great ways to make small changes. In the beginning, it probably is not necessary to hire an accountant full-time. The best way to manage in the beginning is by outsourcing the accounting services, which enables you to pay only for the exact accounting support your startup needs. The issue with many small businesses is that they avoid this area of their business, and then the business fails. Remember that proper, responsible time management of any task, especially accounting, is key. Fontenot & Associates Solutions LLC, specializes in accounting and business operations services because we understand and recognize the importance of accounting processes and strive to be a part of the solution to building successful businesses, one at a time. |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed