|

Well, maybe this blog will not make you snuggle up with an Accounting book at night and call it your BFF but I will go for making you two close friends. Close friends because you need this person in your life for your business to be successful. There are millions of small business owners and startup entrepreneurs who are masters at creating products and services and winning over customers. However, many of them are weak in understanding the accounting area of the business. To be effective in grasping the concept of accounting, I find it useful to understand some of the commonly used terminology. Essentially, accounting is about managing debits and credits. Those debits and credit are recorded and managed by the business owner, consultant or bookkeeper of the business, mainly to ensure money is coming into the bank and expenses are being paid timely. The American Accounting Association (AAA) defines accounting as “the process of identifying, measuring and communicating economic information to permit informed judgement and decision by users of the information.” The basic formula to accounting is: Assets = Liabilities + Equity (Owner’s equity)  Knowing the basics equation, outlined above, will assist in the understanding of accounting account types. There are different types of accounts in which debits and credits are kept track of in accounting, let’s define some them,

When managing your business, these definitions will be used quite frequently especially if you have hired a consultant or bookkeeping to manage the accounting area of your business. Let’s say your current business is a hair professional in a Salon and at the end of the day your analyzing how much you made for the day. Your recording book shows:

The owner of the salon may generally record total earned revenues of $175. However, to an accountant or bookkeeper they are also concerned with how much it cost (expenses) the Salon owner to make the two conditioners she sold for $10 each and how much was it to purchase the comb and hair sprays. Understanding this information gives the true net revenue amount of how much the salon owner made for her one day of work. The take away here, is to remember it takes more than developing marketing techniques and creating new products and services to manage a business. As a business owner, your accounting processes and methods used to analyze should be your BFF in the business because without it, you can never know where it stands or how healthy or unhealthy it is. If you understand the importance of accounting to your business and are ready to protect your business from financial risk, visit our website to schedule your consultation.

0 Comments

Deciding to establish a nonprofit organization is a process. One of the key task to accomplish is filing for federal tax exemption. "You will need to file with the Internal Revenue Service for tax exempt status under Section 501©. Form 1023 is the multi-page form you will need to file. Within three to six months of submitting your paperwork, you generally will receive a letter, granting tax-exempt status to your organization." "Organizations that achieve 501©(3) status are exempt from federal taxes, and contributions given to them are deductible by donors for income tax purposes. Certain states allow state-level tax-exempt status, and in such cases, the net profit is also exempt from payment of state income taxes. In addition, the overwhelming majority of private foundation in the U.S. award grants only to organizations that have this particular tax-exempt status."

If you are planning to apply for the tax-exempt status, here are a few tips that may help save time and effort with the IRS.

Maintaining a tax-exempt status does have its benefits also:

You can find more tips by visiting the IRS website. Fontenot & Associates Solutions, LLC is proud of your idea and mission to build s successful nonprofit organization. We are here to help you build an extensive guide that will support you along the way. Our goal is to deliver sustainable tools that will help build and grow your ideas and community mission. An organization in which no owner, stockholder to trustee shares in profits and losses, and which exists not to earn revenue but to promote a mission that typically but not necessarily enhances the public welfare is considered a nonprofit. Generally, there are four categories of nonprofit organizations:

When building a nonprofit organization, the organizers and founders tend to start their journey with the main focus of funding. Funding that will bring activity and quality performance. Performance that must be organized in order for the funds and sponsorships to increase or grow.

Organizational growth is a process and will not occur overnight. The process includes understanding shortfalls will occur, some processes will take longer to accomplish to others and that areas such as fundraising must always continue to grow in a variety. For example, as a nonprofit it will be a challenge to maintain the organization and support the community if all of the funds are only via donations. However, if the tools and strategies included additional options such as,

All of these areas of fundraising take effort and dedication from the leaders and volunteers to the cause. Effectively communicating success stories arising from successful delivery of the organization’s services keeps donors and/or members committed to the ongoing financial support of the organization. Here are some resources you may take advantage of:

Don’t be afraid to take advance of resources to help you run and grow your nonprofit more effectively. In addition, establishing a policy and procedure guide will be critical to those who support your mission such as volunteers and donors, Fontenot & Associates Solutions, LLC can help get you started. Visit our website, we are just a click away. "Success is not final; failure is not fatal: It is the courage to continue that counts." It’s not every day entrepreneurs think about the accounting processes within their business. Accounting is not all about just collecting revenue but more so about the steps it takes to ensure the process to collect money does exist and is clear to the leaders and staff. There are no shortages of details to consider when you’re a small business owner. Getting the back-office basics of accounting in order can make or break a business as it exist in any phase -- start-up, growth or expansion. Let's think about it, fees alone can be “atrocious” thus many experts recommend using an accounting software that will capture all accounting aspects of the business. It is important to pick a software that will suit your business needs not those of a colleague or friend. I say this because what is good for one business owner may not be good for another. However, if you are a business that cannot afford the cost of an accounting software and would rather maintain control in Excel worksheets then it's highly recommended a procedure guide is developed. The guide will provide direction and transparency to an important process within your business. Get your small business in order by starting with these tips:

1. One of the obvious and repeated suggestions is separating business and personal expenses. When it’s time to tally up deductible expenses, you want to be ready. Start today! 2. Understand when it’s time to pay for support. Choosing to hire a consultant or outsource a part of your business process can make a big difference. Not only do you get some of your time back to use on bigger projects you are also investing someone who speaks the professional language in those specific areas. 3. Dedicate time to update your records. Many business owners may choose not to hire a professional consultant to support with updating their accounting records or performing data entry. However, this decision can make a difference in the business. 4. Follow Up on Invoices and Receivables. Many business owners still invoice their customers and wait for payment. It will be key to plan for necessary follow-up calls to ensure the expected revenue remains consistent as budgeted. These accounting tips are all great ways to make small changes. Remember that proper, responsible time management of any task, especially accounting, is key. If you need support to get transition roles, Fontenot & Associates Solutions LLC, can work one to one with you on getting started. Establishing your own nonprofit organization does not have to be a stressful task. However, your organization must incorporate a vital mission with clear lines of accountability and high quality programs and services. Think of it as a for-profit business when planning for success, just because it is a nonprofit organization does not mean you should not see it as a business Fontenot & Associates Solutions, LLC has identified task and processes to be accomplished in order to recognize your organization as a nonprofit. Fontenot & Associates Solutions, LLC will list a few: 1.File the Certificate of Incorporation In the United States, nonprofits an operate as incorporated associations, charitable trusts, or corporations. As you prepare the articles of incorporation, you will need to determine the name of the organization, where the organization will be headquarted, and its overall purpose. 2.Obtain an employer identification number (EIN) To open one or more bank accounts in the name of the organization (and to file Form 990 with the IRS after each fiscal year), you will need to obtain an EIN, also called a federal tax identification. 3.Establish bylaws and board policies Bylaws define how a nonprofit organization will be managed and how it will run. They determine which staff and board members have authority and decision-making responsibilities and how those responsibilities should be carried out. These are just a few of a group of other tips and steps to consider when starting down this path. The nature of service, nonprofit, also means these organizations play a different set of rules and laws established by state and federal authorities. Some of the distinctive features that should be understood by the individuals preparing to enter this field are:

Once your vision has been painted clearly for others to see, and you have developed a mission statement and action plan to serve as a roadmap for implementation, it is time to pursue your passion. With that being said, don’t’ be afraid to seek professional support during your process if you need advice, support with documenting or legal support.

Remember to develop a team and volunteers who share your vision and passion, you want doers, those who are diverse in talent and want to see the organization work out. You may have to complete this process more than once so find ways to have your volunteer team engaged during the slow periods or start-up phase. This is a great period to educate, train, market and network. As an added tip, below is a link to the IRS website so that you may learn more about the 501© form. 501 ( c) information: https://www.irs.gov/charities-non-profits/charitable-organizations/exemption-requirements-section-501-c-3-organizations You are on your way to building a wonderful organization and your community looks forward to supporting you and your success. If your needing to establish a written outline for your organization, Fontenot & Associates Solutions, LLC is just a click away. When an idea is developed into a business, establishing the accounting processes to track the revenue and expenses is generally not on the top of the list. A chart of accounts short name is (COA) and is defined as “a listing of the names of accounts that a company has identified and made available for recording transactions in its general ledger.” A chart of accounts has standard accounts you may see despite the industry of business you work in. However, typically the order of the accounts are as follows: Balance sheet accounts:

Income statement accounts:

Your account receivables are considered an asset, and so is your income but they are two completely different things. Account receivables are created by the sale of goods or services but income is what you have received from the sale of goods or services. You see, if you bill a customer and give them time to pay it is accounts receivable, and when you receive the money via deposit into your bank account then that is income. Many business owners may be using an accounting software to manage their chart of accounts. The software may provide a list of custom accounts to use but it will be the responsibility of the respective business owner to add custom accounts to ensure finances are recorded accurately. Below is an example of the chart of accounts for a Salon professional: Assets:

Fixed Assets:

Expenses:

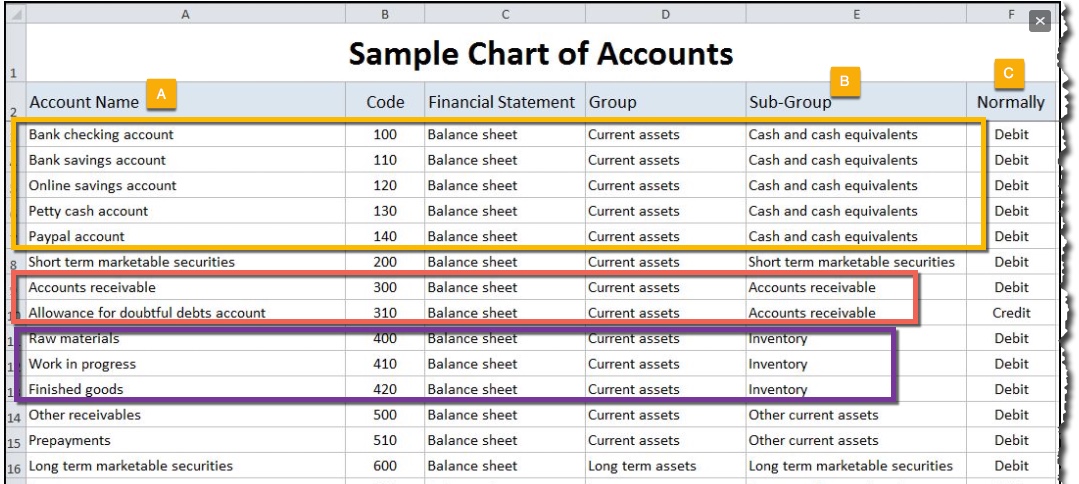

A chart of accounts generally serves as an outline for the business structure and is a tool for gathering and organizing financial information. The chart of accounts example below is one sample guide. It identifies the account name (A), this name will depend on your type of business and sub-group (B), is dividing the chart of accounts into groups for financial representation and normally (C), indicates whether the account is normally increased by a debit entry or credit. For example, depending on the size of business the leader may have one individual responsible for reconciling all of the cash accounts to ensure online, in-store or one-time made purchases are all accounted for on a daily basis. But, in another business the leader may assign cash and accounts receivable to one individual (not recommended, but could happen) and they would be responsible for ensuring all cashed is received and accounted plus for in addition,

The debit and credit column indicates whether the account is normally increased by a debit or a credit. As an example, expense accounts are normally increased by a debit entry but income accounts are increased by a credit. If your looking to strengthen the accounting processes of your business, Fontenot & Associates Solutions LLC has the skills and tools to get you started. Even though your business may be a one person shop, the organization of your finances should be accurate and organized from day one. Getting started is simple, let us show you how. How is that Going for You? How does one define a non-profit organization? It has been defined as entities that perform charitable services by accepting funds from the general public. To help regulate the activities and encourage proper allocation of funds, accounting standards have been put in place by the Financial Accounting Standards Board also known as FASB. The accounting standards are used by management of non-profit organizations as a guide to record transactions and comply with program requirements. Many non-profit organizations exist to accomplish a goal and not to return a profit however as funding opportunities present themselves and partnerships begin to form, the financial statements will need to be accurately managed by a designated accountant or management. The finances are generally budgeted and every line item within the financials are accounted for. The operational budget is the foundation from which all of the work will be carried out. It allows you to establish benchmarks and determine priorities. In addition, it brings light to the variable cost which may exist and allows management to analyze and change the to fixed cost. Here are some key steps in developing your budget:

These steps are sufficient and valid for a newly established non-profit organization and those who have been established for five or more years. A well established and maintained budget is what donors look for. Donors want to know where the money is going. They want to give their money away to "a worthy cause", and it is management's responsibility to show them that that's what is occurring. Showing that you're non-profit organization is worthy starts with a good budgeting process which engages those who are responsible for adhering to the budget and implementing the organization's objectives in creating the budget. Get started today with the annual budgeting process, is it documented, with task, responsibility assignments and deadlines clearly state? It is never too late to get started. Fontenot & Associates Solutions, LLC offers the skills and experience to prepare the annual budgeting procedures in advance which will ensure proper delegation of assignments and the delivery of a clear message. The meaning of life is to find your gift. The purpose of life is to give it away." - Pablo Picasso |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed