|

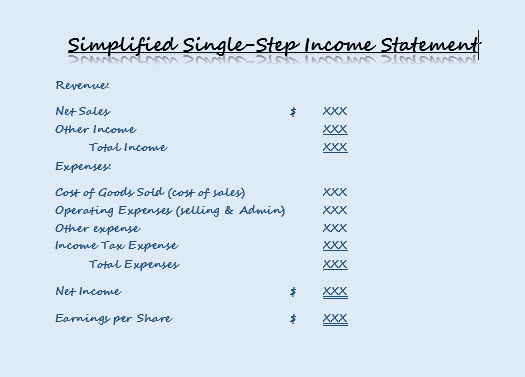

Some companies use a single-step income statement, which totals revenues and gains (sales, other income, etc.) and then deducts total expenses and losses (cost of goods sold, operating expenses, other expenses, etc.). A simplified single-step income statement is similar to below: As an owner responsible for the creation of your financial statements, it key to understand the set-up of your companies income statement. This example, shows all revenues and gains and then lists all expenses and losses. Total expenses and loss items deducted from total revenue and gain items determine the net income. Ideas are easy. Implementation is hard." - Gary Kawasaki, founder of AllTop Source: Financial Reporting and Analysis 12E

1 Comment

11/24/2023 10:42:05 am

I wanted to express my gratitude for your insightful and engaging article. Your writing is clear and easy to follow, and I appreciated the way you presented your ideas in a thoughtful and organized manner. Your analysis was both thought-provoking and well-researched, and I enjoyed the real-life examples you used to illustrate your points. Your article has provided me with a fresh perspective on the subject matter and has inspired me to think more deeply about this topic.

Reply

Leave a Reply. |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed