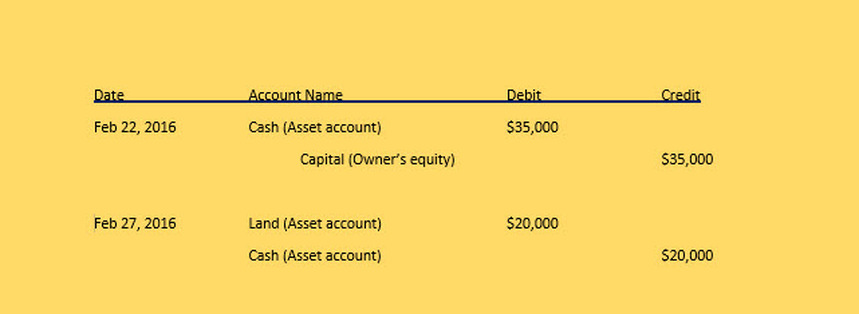

Purchasing Land for your Business - How to Record Journal? Many small business owners will make a personal initial investment as part of the first phase in their start up. Those funds should be deposited into the business bank account and the journal entry to be recorded is similar to below - in this example, $35,000 is the initial investment. The accountant would debit cash and credit capital, this accounting journal is the recording the investment to your business. Now let's assume that you have leased a location for 2 years and are now planning to purchase land and build your own store front location. The journal entry for the Land would be similar to below (dated, February 27, 2016). The accountant would reduce the cash general ledger account (with a credit) to reflect land purchase of $20,000 and at the same time record an entry for the land purchase (a debit to Land general ledger account), which is also an asset account for $20,000. Overall, it does not change your assets total balance - Assets $35,000-$20,000+$20,000 = $35,000. Source: Corporate Financial Accounting Get up and start your new day. It's just that simple.

0 Comments

Leave a Reply. |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed