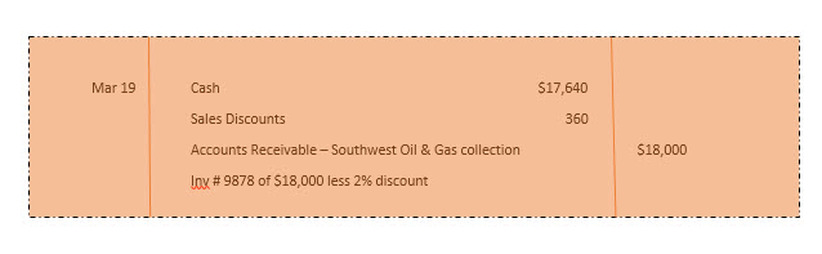

Continue building your vision everyday until you start to see the reality of it all." - Fontenot & Associates Solutions What are Sales Discounts? A seller may offer the buyer credit terms that include a discount for early payment. The seller refers to such discounts as sales discounts. Sales discounts reduce sales revenue. To reduce sales revenue, the sales account could be debited. However, managers usually want to know the amount of the sales discounts for a period. For this reason, sales discounts are recorded in a separate sales discounts account, which is a offsetting account to sales. Here is an example: Assume that Fontenot & Associates Solutions sold $18,000 of merchandise to Southwest Oil & Gas on March 10 with credit terms 2/10, n/30. Under the credit terms, Southwest Oil & Gas has until March 20 (March 10 plus 10 days) to pay within the discount period. We will assume Southwest Oil & Gas pays the invoice on March 19. Since the invoice is paid within the discount period (10 days), Southwest Oil & Gas would deduct $360 ($18,000 X 2%) from the invoice amount of $18,000 and pay $17,640. The transaction would be recorded similar to below: Being able to track the amount of discounts your business if offering each quarter provides a great snapshot to how much the company has sold and potentially how much the company will forecast for the upcoming quarter. Having established policies and procedures in place would provide management with additional assurance that the financial recordings are being processed accurately. Source: Corporate Financial Accounting 12E

0 Comments

Leave a Reply. |

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed