|

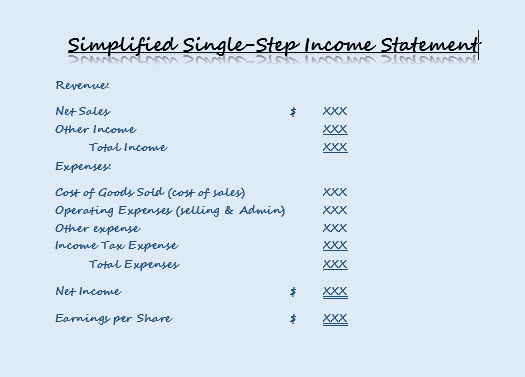

Some companies use a single-step income statement, which totals revenues and gains (sales, other income, etc.) and then deducts total expenses and losses (cost of goods sold, operating expenses, other expenses, etc.). A simplified single-step income statement is similar to below: As an owner responsible for the creation of your financial statements, it key to understand the set-up of your companies income statement. This example, shows all revenues and gains and then lists all expenses and losses. Total expenses and loss items deducted from total revenue and gain items determine the net income. Ideas are easy. Implementation is hard." - Gary Kawasaki, founder of AllTop Source: Financial Reporting and Analysis 12E

1 Comment

Sometimes you just have to ask for what you want." - Fontenot & Associates Solutions When the decision is made to invest your funds into a franchise, it's important to make sure you invest wisely. FranChoice was viewed in the Entrepreneur magazine and can potentially be an option to have your questions answered. The consultation service is $0 dollars and offered by industry.

Share with your colleagues. We wish you much success! As an entrepreneur, we have already decided to take the good with the bad." - Fontenot & Associates Solutions Companies of all Sizes should have a Guide to MonitoringMonitoring the internal control system is used to locate weaknesses and improve controls. Monitoring often includes observing employee behavior and accounting system for indicators of control problems. Some indicators are below: Warning signs with regard to people:

Source: Corporate Financial Accounting 12E

There is always something to be thankful for." - Unknown 3 Available Options for Start-up CompaniesI know many may believe that starting a company with few funds is even possible. But after reading an article from the Entrepreneur magazine -- I would encourage everyone planning to launch their new venture to read the 3 options available and use them when establishing their business plan.

Oil & Gas IndustryPetroleum companies are interested in securing the rights to drill for and produce subsurface minerals. The existence of minerals is uncertain until a drilling rig has probed the earth to the depth at which exploration information has suggested that deposits of oil and gas are likely to be found. Sometimes these rights may be secured by simply purchasing the fee interest in the property, which results in outright ownership of both surface and minerals. In almost every case, the right to explore and produce is obtained by means of an oil and gas lease or a mineral lease. Source: Petroleum Accounting

It's nothing like having a plan for the unexpected." - Fontenot & Associates Solutions The company's checking account balance in the bank records is a liability. Thus, in the bank's records, the company account has a credit balance. Since the bank statement is prepared from the bank's point of view, a credit memo entry on the bank statement indicates an increase (a credit) to the company's account. Likewise, a debit memo entry on the bank statement indicates a decrease (a debit) in the company's account.

Customers' checks returned for not sufficient funds, called NSF checks, are customer checks that were initially deposited but were not paid by customer's bank. How are you handling these special occurrences in review of your cash monthly? This incident would mean your bank account has more money than it should because your customer's check was returned by their bank. A great reason to have support with your bookkeeping or a "Know How" guide to support your staff with the step by steps of how to analyze and make corrections to the financials when required. Did you Miss it?While we know there is no such thing as overnight success, thus, we have prepared the 5 Top Entrepreneur Success Tips guide, just for you. It is full of a list of great tips to support your on your road to success because deciding to become an ENTREPRENEUR was one of the best steps you could have taken.

Visit our website to enter your information and a FREE copy will be emailed directly to you! Cash is Critical for SurvivalFor startup companies or companies in financial distress, cash is critical for survival. In their first few years, startup companies often report losses and negative net cash flows from operations. In such case, the ratio of cash to monthly cash expenses is useful for assessing how long a company can continue to operate without:

Stay connected with us on social media to learn more about the importance of performing analysis of your company as a monthly task. Source: Corporate Financial Accounting 12E

Why go small, dream big." - Fontenot & Associates Solutions The Receivables result in SalesThe receivables that result from sales on account are normally accounts receivable or notes receivable. The term receivables includes all money claims against other entities, including people, companies and other organizations. Receivables are usually a significant portion of the total current assets. Notes receivable are amounts that customers owe for which a formal, written instrument of credit has been issued. If notes receivable are expected to be collected within a year, they are classified on the balance sheet as current asset. Notes are often used for credit periods of more than 60 days. For example, an automobile dealer may require a down payment at the time of sales and accept a note or a series of notes for the remainder. Such notes usually provide for monthly payments. Other receivables include interest receivable, taxes receivable, and receivables from officers or employees. Other receivable are normally reported separately on the balance sheet. If they are expected to be collected within one year, they are classified as current assets. Source: Corporate Financial Accounting 12E

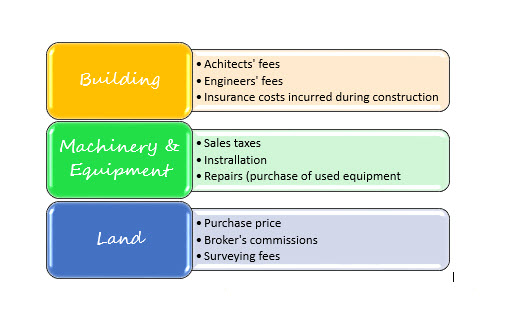

Let's Talk Fixed AssetsAs an entrepreneur the plan to expand your brand by purchasing a store front or Land to build you must understand all of the cost which will be incurred during this process. You will need to update your budget. Increase your forecast of expense because expanding does mean more cost. The cost of acquiring fixed assets include all amounts spent getting the asset in place and ready for use. For example, freight costs and the cost of installing equipment are part of the asset's total cost. The snapshot below provides a few of the common cost of acquiring fixed assets. These cost are recorded by debiting the related fixed assets account, such as Land, Building, or Machinery and Equipment. Only cost necessary for preparing the fixed asset for use are included as a cost of the asset.

|

Archives

July 2022

Categories

All

AuthorMy mission is to offer the best accounting and operations solutions and tips for entrepreneurs and small to mid-size companies worldwide seeking to close their process gaps with actual solutions. |

We Work to Provide Unique Solutions"Our team of innovative professionals use their knowledge and experience to set your business and team of professionals up for success. Our extensive accounting and operations skills are a start and key tools to company growth, building team cohesiveness, establishing clear purpose and goals, and improving process inefficiencies. Our services are key to businesses of all sizes. We handle providing the detail framework to your business so that you may focus on building your business. |

Contact UsSTAY CONNECTEDNEWS & TIPS IN YOUR INBOX

|

RSS Feed

RSS Feed